Knowledge from Glassnode has revealed that the Bitcoin provide is progressively spreading from whales and exchanges to smaller palms over time.

Bitcoin provide reveals sluggish unfold in the direction of smaller holders

In response to a brand new report printed by the chain evaluation agency Glassnode, traders with lower than 50 BTC have lately absorbed probably the most important quantity of cash.

One thing BTC critics typically maintain up towards the cryptocurrency is the distribution of provide. They declare that the availability is very concentrated round a number of whales, giving the existence of huge wallets as proof.

To examine whether or not this truth holds, Glassnode studied the availability distribution of the market by dividing traders into totally different cohorts. These keeper teams are outlined by the analysis agency as follows: shrimp (<1 BTC), krabbe (1-10 BTC), blekksprut (10-50 BTC), fisk (50-100 BTC), delfin (100-500 BTC) , hai (500-1.000 BTC), hval (1.000-5.000 BTC) og pukkelrygg (>5,000 BTC).

The provides to exchanges and miners are additionally thought of for the classification. A related indicator right here is the “annual absorption charges”, which measure the annual change within the provides of the totally different cohorts as a proportion of the overall quantity of cash issued (that’s, the recent provide miners produce).

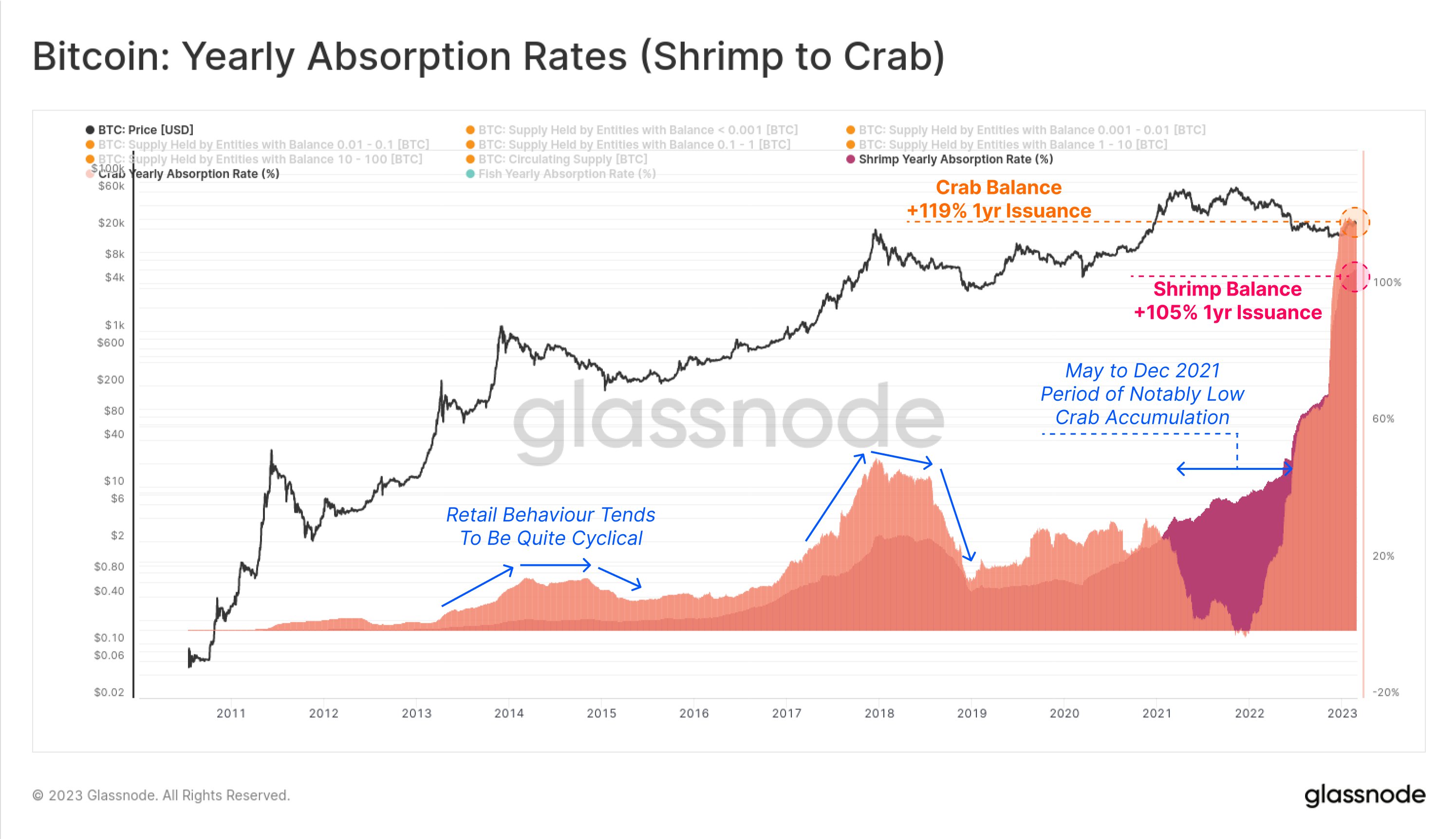

First, here is a chart exhibiting how annual absorption charges for shrimp and crab have modified over the cryptocurrency’s lifetime:

Appears to be like just like the metrics have proven excessive values in current days | Supply: Glassnode

As proven within the graph above, the Bitcoin shrimp and crab have lately seen document absorption charges of round 105% and 119% respectively.

Because of this the shrimp provide has grown by 105% of what the miners produced over the previous yr, whereas the crabs have added an much more important proportion of 119%.

Regardless that the BTC miners gave out 100% of what they mined within the final yr, these teams nonetheless absorbed an additional provide. The place did these further cash come from? The absorption charges of the opposite cohorts could maintain the reply to that.

The absorption charges of the sharks and whales | Supply: Glassnode

From the chart it’s clear that sharks have had a barely optimistic annual absorption charge lately. The whales have nonetheless seen a detrimental indicator worth, which means that this cohort has unfold out over the previous yr.

The mixed change in provides to each of those cohorts can also be a internet detrimental because the distribution of the whales far outweighs what the sharks accrued throughout this era.

Knowledge for the absorption charges of the exchanges additionally present detrimental values, which means that these platforms have launched many cash in circulation.

The extremely detrimental absorption charges proven by exchanges | Supply: Glassnode

The smaller Bitcoin entities have picked up the cash distributed by these cohorts. Curiously, whereas this shift in providing has been extraordinarily current, it’s a pattern that has endured through the years.

Because the chart beneath highlights, the availability held by smaller entities (with lower than 50 BTC) has progressively gained dominance all through cryptocurrency historical past.

The rise of the shrimps and different small traders | Supply: Glassnode

Though the proportion of the whales could have been fairly important at one time, as we speak their shares have shrunk to solely 34.4% of the complete circulating provide, which, whereas nonetheless important, is way smaller than the 62.7% across the time of the whales. first halving, the occasions that halve BTC mining rewards, again in 2012.

The gradual shift in provide additionally appears to go in the direction of the smallest models, that are the retail traders. This can be a signal that cryptocurrency is turning into extra widespread as adoption will increase.

BTC worth

On the time of writing, Bitcoin is buying and selling round $24,300, up 10% within the final week.

BTC observes a pullback | Supply: BTCUSD on TradingView

Featured picture from Dmitry Demidko at Unsplash.com, Charts from TradingView.com, Glassnode.com