On-chain information exhibits that Bitcoin revenue quantity has shot up after the cryptocurrency’s worth briefly broke above the $27,000 stage.

Bitcoin observes 2.4 instances as many revenue transfers as losses

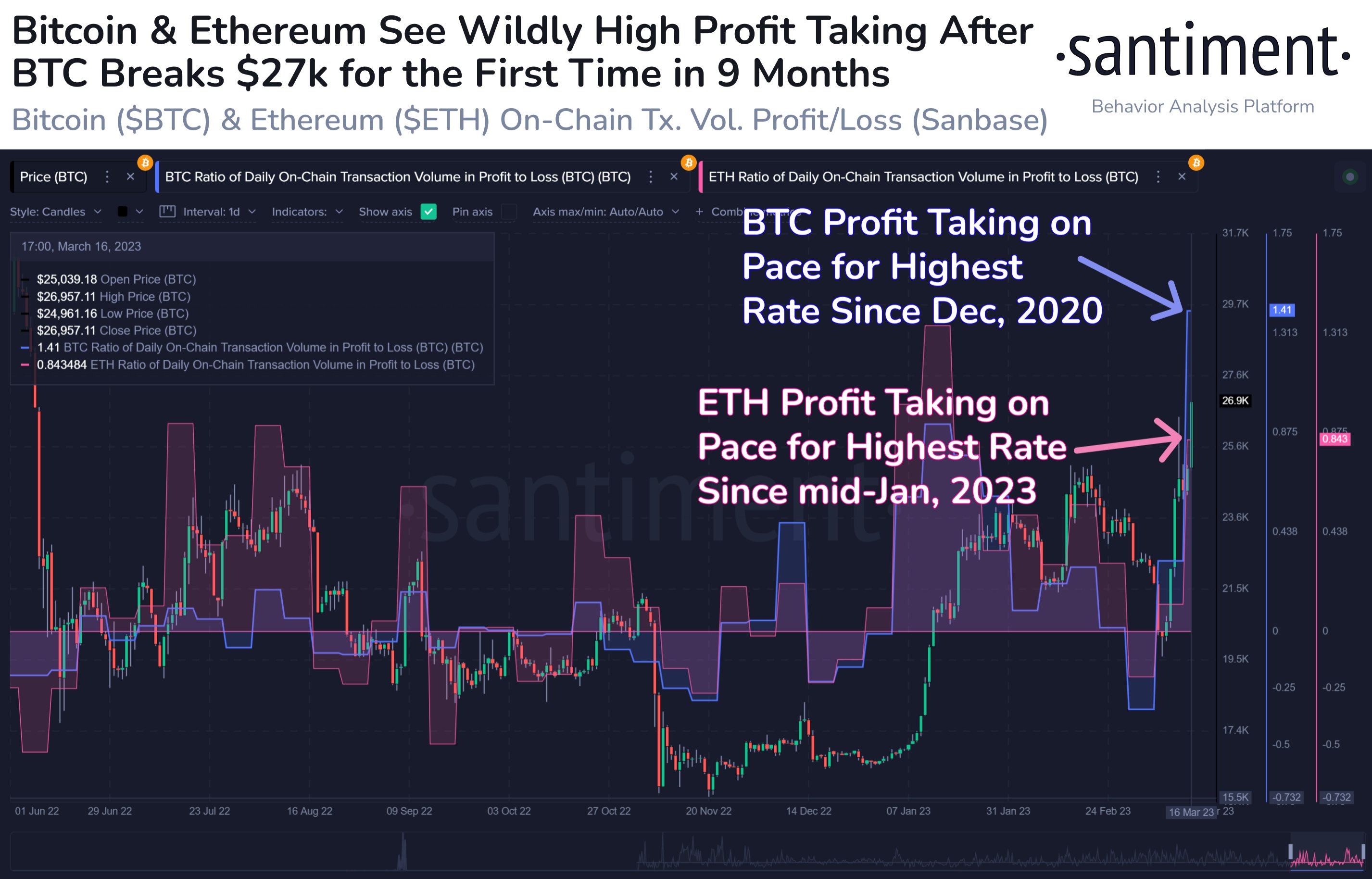

In response to information from the evaluation firm on the chain Sentimentthis stage of profit-taking has not been seen since December 2020. The related indicator right here is the “Ratio of every day on-chain transaction quantity in revenue to loss,” Because the title already suggests, it measures the ratio of the Bitcoin quantity of profit-taking transactions to loss-making transactions.

This calculation tells us whether or not there may be extra revenue harvesting available in the market than loss realization or not proper now. The indicator has a constructive worth if the revenue quantity is larger. In any other case it’s damaging.

The indicator works by going via the chain of every coin being offered/transferred to see the value it was final moved to. If this earlier sale worth of a coin was lower than the BTC worth proper now, this specific coin moved with revenue and thus the transaction is counted beneath the revenue quantity. Equally, if the final worth exceeds the final worth, the coin sale contributes to the misplaced quantity.

Now, here’s a chart exhibiting the pattern within the ratio of every day on-chain transaction quantity in revenue and loss for Bitcoin, in addition to for Ethereum, over the previous yr:

The values of the 2 metrics appear to have been comparatively excessive in latest days | Supply: Santiment on Twitter

The graph above exhibits that the Bitcoin profit-to-loss quantity ratio has been fully elevated in latest days. With the newest rise in worth above the $27,000 stage (which lasted solely briefly earlier than the coin fell again beneath the mark), the indicator has seen a good sharper high.

On this enhance, the metric has achieved a price of round 1.4, which means that the profit-taking transaction quantity is round 2.4 instances greater than the loss-making one. This indicator stage is the best since December 2020, when the 2021 bull run was in its preliminary section.

This excessive revenue quantity means that buyers are fearing draw back proper now and they also rushed to reap some earnings as quickly as the value broke above the $27,000 stage. Promoting stress from these revenue takers was possible behind the pullback to the $26,000 stage.

The determine exhibits that Ethereum’s revenue taking quantity has additionally risen considerably in latest days. Nonetheless, the cryptocurrency solely observes the best worth of the indicator since mid-2023, and solely slightly additional again than is the case for Bitcoin.

BTC worth

On the time of writing, Bitcoin is buying and selling round $26,800, up 34% prior to now week.

It seems to be like the worth of the asset has shot up over the previous 24 hours | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, Charts from TradingView.com, Santiment.internet