On-chain knowledge exhibits that Ethereum has seen large inflows of $505 million into Binance over the previous 24 hours, an indication {that a} selloff could also be underway.

Ethereum change provide has elevated over the previous 24 hours

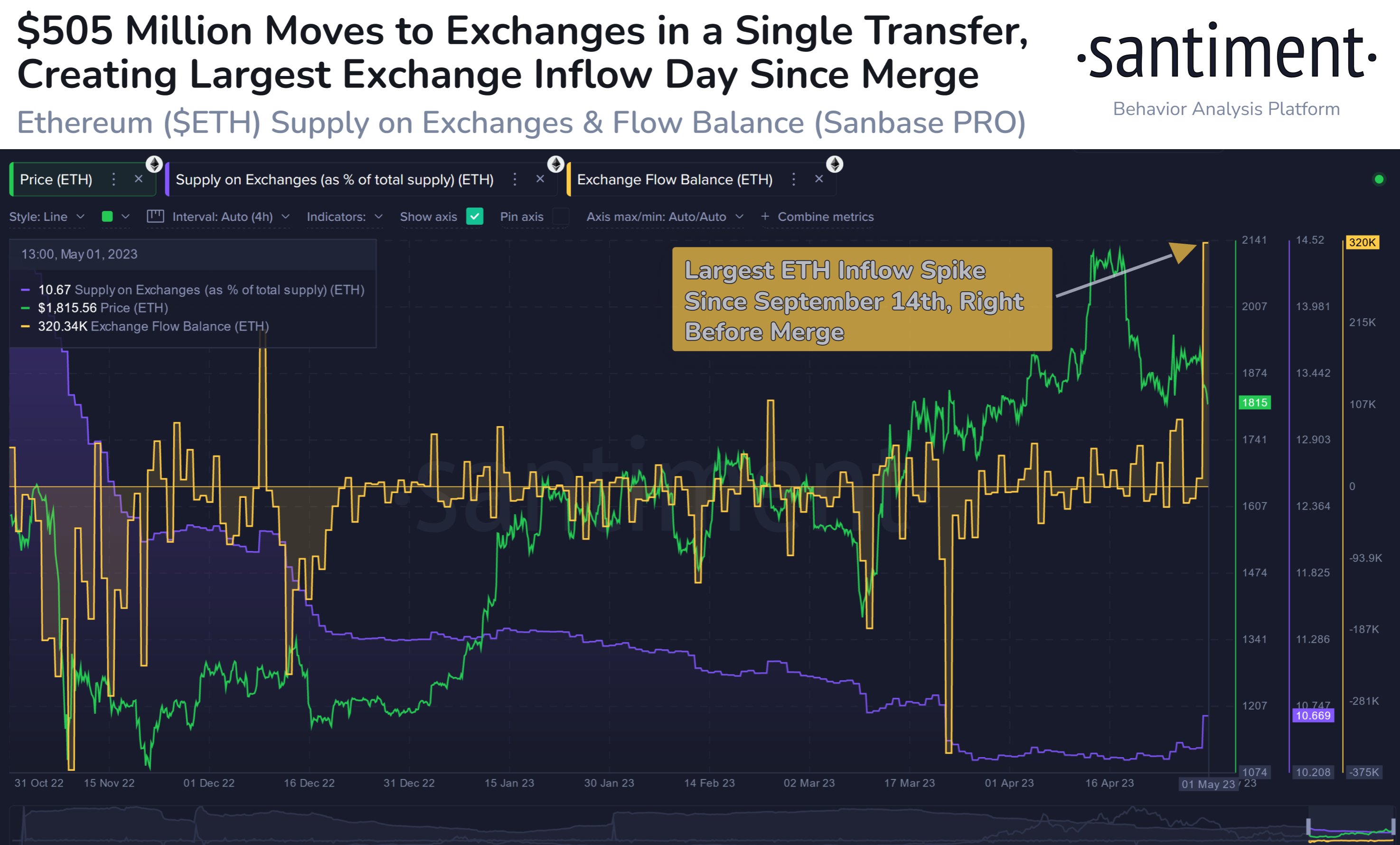

Based on knowledge from the evaluation firm on the chain Sentiment, this improve in provide on exchanges is the most important noticed for the reason that day earlier than the merger. The “provide of exchanges” is an indicator that, because the identify already suggests, measures the share of the entire Ethereum provide presently sitting within the wallets of all centralized exchanges.

Associated Studying: Bitcoin Bearish Sign: Miners Proceed to Promote

When the worth of this metric will increase, it signifies that buyers are depositing some cash to exchanges proper now. Such a pattern can have bearish implications for the asset’s worth, as one of many predominant causes buyers switch their cash to exchanges is for sales-related functions.

Then again, lowering values of this indicator recommend {that a} internet quantity of ETH is leaving these platforms for the time being. Such withdrawals generally is a signal that holders are accumulating the cryptocurrency, which may naturally be bullish for the asset’s worth in the long run.

Now, here’s a chart exhibiting the pattern of Ethereum provide on exchanges in the previous few months:

Seems to be like the worth of the metric has shot up in latest days | Supply: Santiment on Twitter

As proven within the above graph, the Ethereum provide on exchanges has noticed a pointy improve within the final day, which signifies that buyers have deposited a considerable amount of ETH to those platforms.

Within the chart, there may be additionally knowledge for an additional ETH indicator: the “change circulate steadiness.” This calculation measures the web variety of cash flowing into or out of exchanges, which signifies that the change circulate steadiness basically tracks the modifications that happen within the provide of the exchanges indicator.

Over the past 24 hours, this metric has had a big constructive worth, which signifies that inflows have far exceeded outflows throughout this era. Based on the calculation, about 320,000 ETH ($584.6 million on the present worth) have entered the wallets of the exchanges with this spike.

This internet improve in change provide is definitely the most important the cryptocurrency has seen since September 14, 2022, the day earlier than the transition to the proof-of-stake consensus mechanism came about.

Apparently, the overwhelming majority of the surge in inflows has been contributed by only one switch, as knowledge from cryptocurrency transaction monitoring service Whale Alert exhibits.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 273 781 #ETH (504,986,096 USD) transferred from unknown pockets to #Binancehttps://t.co/WHqdlSQ5uB

— Whale Alert (@whale_alert) 1 Could 2023

This switch to Binance was value virtually $505 million, and it is among the largest transactions between an unknown pockets and an change noticed within the final 5 years.

It’s unsure whether or not the whale has made this accretion with the intention of promoting, or to make use of another of the companies provided by the platform. But when promoting is de facto the aim right here, this large inflow could possibly be dangerous information for the asset’s worth.

ETH worth

On the time of writing, Ethereum is buying and selling round $1,800, up 1% up to now week.

ETH has gone down over the last couple of days | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, Charts from TradingView.com, Santiment.internet