It’s jobs Friday, already! Can a goldilocks nonfarm payrolls report assist cease the most recent market wobble by boosting hopes the Fed will cease mountain climbing?

Shares have stalled this week as longer-duration bond yields transfer in direction of multi-month highs after the Treasury mentioned it will borrow $1 trillion within the third quarter.

And considerably, this yr’s rally that has the S&P 500

up 17.3% and the Nasdaq Composite

up 33.4% appears to have left merchants more and more extra prepared to search out an excuse for promoting.

Take into account the continued second quarter reporting season: we’re in a Shania Twain market, the place with regards to earnings: “That Don’t Impress Me A lot”.

Bespoke Funding Group notes that as of midweek the season to this point has been barely stronger than regular in relation to beat charges and steering.

Of the 946 reviews, 71% of shares reported higher than anticipated EPS in comparison with consensus analyst estimates, says Bespoke, whereas 61% reported stronger than anticipated revenues. Moreover, 9% of shares have raised ahead steering whereas 8% have lowered steering.

However there’s an issue: value motion. “Usually talking, shares reporting robust outcomes are usually not being rewarded with a better share value as a lot as ordinary, whereas shares reporting weaker outcomes are getting hit even tougher than ordinary,” their analysts say.

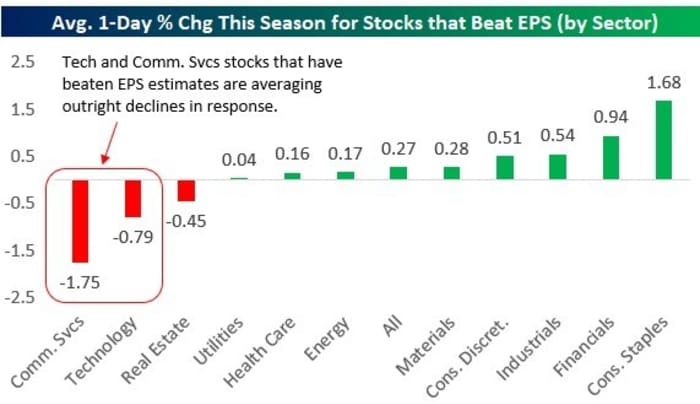

Observe the chart under. Shares that beat earnings per share estimates this season have seen a median one-day share value advance of simply 0.27%, properly under the 10-year common of a 1.58% acquire. These shares lacking EPS forecasts averaged a one-day decline of three.54%, barely worse than the 10-year common, whereas these reporting inline EPS have misplaced 2.89% this time, a lot worse than the long run common of 1.08%.

Supply: Bespoke Funding Group

The second chart illustrates that its a number of the market’s excessive profile successful sectors of this yr which can be bearing the brunt as few contemporary buyers are left to construct positions after even first rate outcomes.

“It’s the shares within the tech and communication providers sectors which can be in charge for the weak spot. Even the shares which have crushed EPS estimates in these two sectors have averaged fairly huge declines on their earnings response days. Provided that these have been the 2 finest performing sectors of the market YTD heading into earnings season, merchants seem like ‘promoting the information’ proper now,” they conclude.

Supply: Bespoke Funding Group

Maybe, then, buyers ought to contemplate these sectors the place the market is at the moment extra amenable to rewarding earnings efficiency, like vitality.

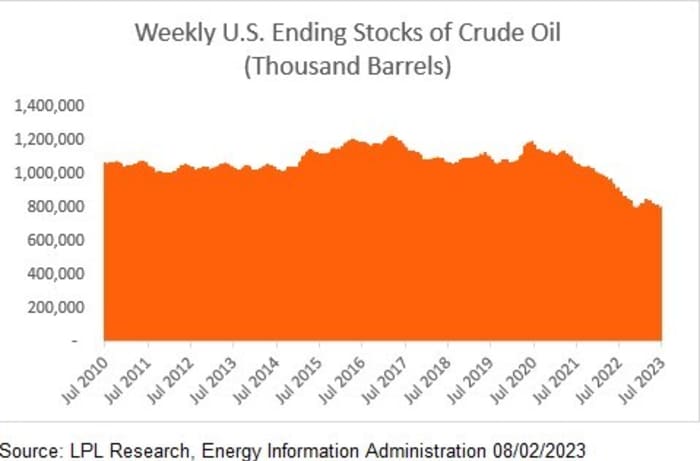

Jeffrey Buchbinder, chief fairness strategist at LPL Monetary, notes that whereas main oil firms have reported plunging second-quarter income due to a lot decrease vitality costs in comparison with a yr in the past, “inventory costs haven’t faltered in a commensurate method.”

LPL holds a ‘impartial’ view on the vitality sector however with a optimistic bias. Sure, the geopolitics and recession fears are a trigger for concern. However provide restrictions — as OPEC+ seeks to curtail output — ought to underpin oil costs. As well as, U.S. shares of crude fell by 17 million barrels for the week to July 28, the most important lower since 1982, when the information was first reported.

Supply: LPL Monetary

Crucially, firms have been emphasizing boosting shareholder worth by rising dividends and endeavor chunky share buybacks, all of the whereas taking a larger deal with stricter value measures.

“We’ve seen each free money circulate yield and money circulate return on invested capital, measures of valuation and profitability, flip optimistic this yr as business administration groups—with strain from Wall Road—have centered much less on manufacturing volumes and extra on profitability,” says Buchbinder.

Markets

U.S. stock-index futures

ES00,

YM00,

NQ00

are greater as benchmark Treasury yields

rise. The greenback

is little modified, whereas oil costs

CL

acquire and gold

GC00

dips.

Attempt your hand on the Barron’s crossword puzzle and sudoku video games, now working each day together with a weekly digital jigsaw based mostly on the week’s cowl story. To see all puzzles, click on right here.

The excitement

The U.S. nonfarm payrolls report will probably be launched at 8:30 a.m. Jap. Economists count on a web 200,000 jobs have been created in July, down from 209,000 in June. The unemployment charge is forecast to stay at 3.6% and month-on-month hourly wages to have grown 0.3%, easing from 0.4%.

Shares of Apple

AAPL

are 1% decrease in premarket buying and selling Friday, after the iPhone maker revealed a 3rd consecutive quarter of gross sales declines.

In distinction, Amazon.com inventory

AMZN

is leaping 8% after beating expectations for its e-commerce and cloud gross sales.

DraftKings

DKNG

shares are up 10% after the net sports-betting platform reported a shock second-quarter revenue and boosted its full-year gross sales forecast.

Corporations releasing earnings on Friday embody Icahn Enterprises

IEP,

Nikola

NKLA,

XPO

XPO

and Dominion Power

D.

Better of the online

How Brookfield made $2 billion in defaults disappear.

Fitch downgrade received’t break Washington’s tax, spending habits.

The insurgent group stopping self-driving automobiles of their tracks – one cone at a time.

The chart

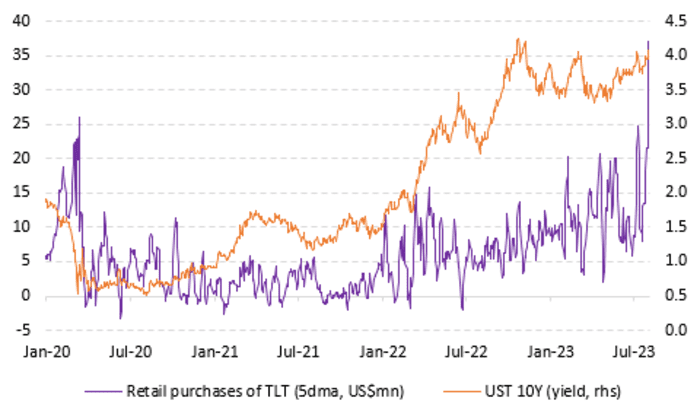

Particular person buyers are piling into longer-duration authorities bonds as yields flirt with multi-month highs. The chart under from Vanda Analysis reveals a surge in retail purchases of the iShares 20+ 12 months Treasury Bond ETF

.

Supply: Vanda Analysis

“TLT was the 4th most-bought ETF on Wednesday behind the Large 3 fairness ETFs [

,

,

]. Notably, the rise in purchases over the previous week simply eclipsed any bond ETF shopping for throughout the Covid downturn of March ’20,” says Vanda

“There’s undoubtedly a yield-focused mindset now throughout sure segments of the retail crowd (probably the older, wealthier ones) because the surge in bond ETF purchases is going on throughout an upward trending fairness market atmosphere relatively than within the midst of a sell-off.”

Prime tickers

Right here have been essentially the most lively stock-market tickers on MarketWatch as of 6 a.m. Jap.

Random reads

The Jell-O shot renaissance.

Telescope captures finish of a star’s life.

Gen Z intern shocks recruiter with record of calls for.

Have to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model will probably be despatched out at about 7:30 a.m. Jap.

Take heed to the Greatest New Concepts in Cash podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton