A Bitcoin on-chain indicator is at the moment trying a breakout that would grow to be a bullish sign for the asset’s worth.

Bitcoin Lively Entities Is Making an attempt To Escape Community Stagnation Vary

In a brand new publish on X, Jamie Coutts, a Bloomberg Intelligence analyst, has mentioned the BTC lively entities metric, and the way it has a powerful relationship with the coin’s worth.

The “lively entities” listed below are a measure of the distinctive whole quantity of Bitcoin addresses which can be taking part in some type of transaction exercise on the blockchain. Naturally, each senders and receivers are counted by the metric.

When the worth of this metric rises, it signifies that an growing variety of customers are partaking with the community. Such a development is an indication of rising adoption for the asset.

However, declining values of the indicator suggest that curiosity within the cryptocurrency could also be waning, as fewer addresses have gotten lively on the blockchain.

The analyst has identified that the lively entities metric has a excessive r-squared worth with Bitcoin.

The r-squared values of the completely different BTC-related metrics | Supply: @Jamie1Coutts on X

From the desk, it’s seen that the r-squared worth for the lively entities is 0.55. What this implies is that 55% of all fluctuations within the cryptocurrency’s worth could be defined by this variable.

There are just a few metrics with the next r-squared worth, making the lively entities an indicator with one of many strongest statistical relationships with BTC. “Importantly, that is additionally a steady relationship over time (ex the wonky pre-2012 knowledge),” Coutts notes.

Appears just like the r-squared worth of the indicator has been fairly steady since 2012 | Supply: @Jamie1Coutts on X

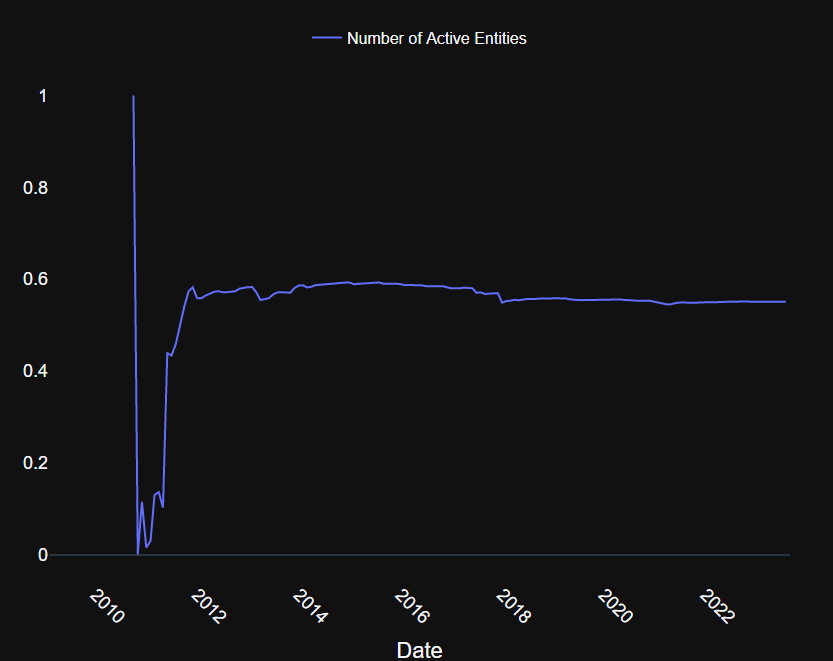

Now, here’s a chart that exhibits how the Bitcoin lively entities have modified in the course of the historical past of the cryptocurrency:

The development within the metric's worth over time | Supply: @Jamie1Coutts on X

As displayed within the graph, the Bitcoin lively addresses have stagnated round every of the cycle lows, however within the intervals between them, it has seen an increase, though the tempo has been getting slower over time.

Since 2021, the indicator has been inside a moderately lengthy section of stagnation, because the indicator has been unable to flee out of a selected vary. It will seem, nevertheless, that issues is likely to be beginning to change for the higher.

The indicator's worth has been on the rise in current days | Supply: @Jamie1Coutts on X

The CMT explains that it’s trying like a TA-style breakout thus far, however it’s not but absolutely clear whether or not the Bitcoin lively entities have really escaped the stagnation vary.

If the metric can handle to remain above the vary for the following few weeks, it is likely to be a affirmation that the additional entities which have began buying and selling on the community are really planning to stay round, and therefore, that constructive adoption is lastly selecting up for Bitcoin.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $25,900, down 11% within the final week.

BTC has continued to wrestle not too long ago | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Bloomberg Intelligence