Knowledge reveals the Bitcoin mining hashrate has remained at excessive ranges just lately, regardless of the hashprice observing a deep plunge.

Bitcoin Hashrate Has Continued To Be Close to All-Time Highs Lately

The “mining hashrate” refers back to the complete computing energy at the moment linked to the Bitcoin blockchain. The metric is measured by way of hashes per second, the place “hashes” confer with calculations that miners should make.

When this indicator’s worth goes up, the miners are connecting extra mining rigs to the community. Such a development can point out that these chain validators are actually discovering the coin enticing to mine.

Then again, the metric’s worth reducing suggests some miners disconnect from the blockchain, probably as a result of they aren’t making any earnings.

Now, here’s a chart that reveals how the 7-day common Bitcoin mining hashrate has modified through the previous yr:

The 7-day common worth of the metric appears to have been going up in current days | Supply: Blockchain.com

Because the above graph reveals, the 7-day common Bitcoin mining hashrate has registered some progress just lately and has set a brand new all-time excessive (ATH). For the reason that crash, the metric has dropped barely, however its worth stays close to ATH ranges.

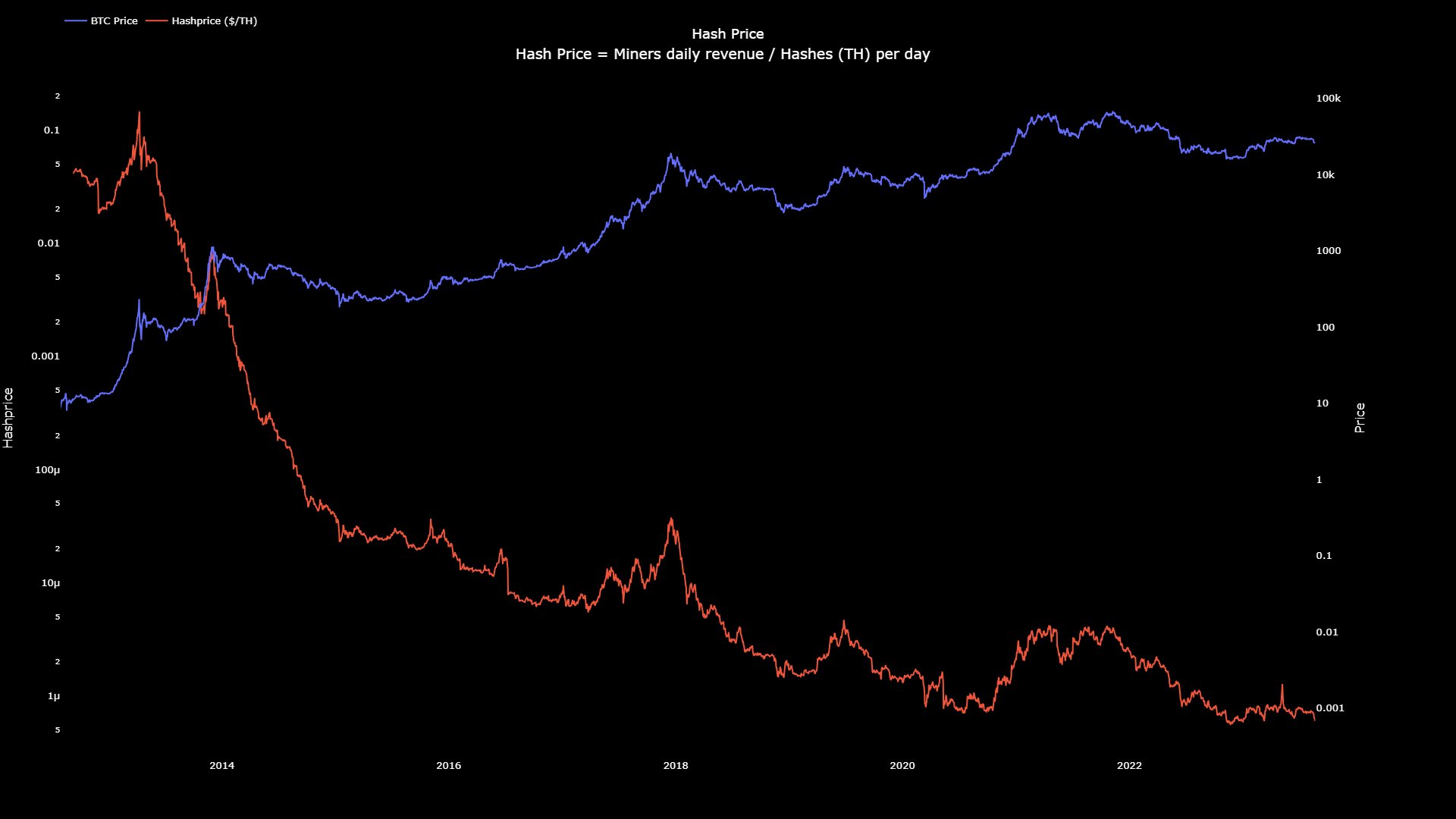

Curiously, the indicator has stayed at these excessive values although the hashprice has taken successful just lately, because the CryptoQuant Netherlands group supervisor Maartunn has identified on X.

Appears just like the metric has been heading down just lately | Supply: @JA_Maartun on X

The “hashprice” right here refers back to the quantity of day by day income the miners make corresponding to each hash they deal with. From the graph, it’s obvious that the indicator’s worth has been on a perpetual downtrend all through the asset’s historical past, a consequence of the hashrate trending up throughout this similar interval.

Block rewards (that’s, the compensation that the miners obtain for fixing blocks) on the community stay practically fixed, so whatever the quantity of hashrate linked to the community, the miners’ complete revenues received’t budge, however slightly their shares can be affected.

Subsequently, as extra hashrate has been coming on-line as a result of rising competitors within the house, the hashprice has continuously decreased. The metric does present native deviations once in a while, although, and these normally correspond to rallies and crashes.

The metric is measured in {dollars}, so it is sensible that the BTC value going up or down would additionally have an effect on the indicator’s worth. Lately, as Bitcoin has crashed, so has the hashprice, and the metric’s worth is now round an all-time low.

Regardless of miners making traditionally low revenues per hash now, they haven’t but considerably disconnected energy from the community. It’s unsure whether or not it will stay the identical within the coming days, but when it does, it could possibly be an indication that the miners are hopeful concerning the long-term final result of the cryptocurrency, so that they don’t see a lot cause to disconnect simply but.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $26,100, up 1% within the final week.

BTC has stagnated for the reason that crash | Supply: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, CryptoQuant.com, Blockchain.com