What are younger buyers getting fallacious today?

Our name of the day from co-founder of knowledge supplier DataTrek, Jessica Rabe, flags seven rookie investing errors being made by Millennial and Gen Z buyers. Whereas simply 29, Rabe has spent a decade writing about and analyzing capital markets.

Right here goes:

-

Making an attempt to select single shares. These could be short-term winners, however “most don’t even beat low-risk U.S. Treasury invoice returns over the long term,” says Rabe, who provides choosing winners requires basic analysis and self-discipline. Simply 2.4% of worldwide shares have been liable for international fairness positive aspects from 1990 to 2020, however massive indexes at all times come again and create worth. Higher to spend money on exchange-traded funds (ETFs) that monitor the S&P 500 — the SPDR S&P 500 ETF Belief

— or the Invesco QQQ Belief

for the Nasdaq 100. - Treating investing like playing. “Most buyers generate profits in the event that they stick with main U.S. inventory indexes for no less than a number of years,” she says, including that regardless of all of the disaster during the last 20 years, the S&P 500 is on the doorstep of a brand new file excessive.

-

Pondering you don’t have sufficient to take a position. Construct up that emergency fund, however then look into shopping for fractional shares in a brokerage account. Placing $100 within the iShares Core S&P 500 ETF

in the present day and $50 month-to-month for 30 years would yield $100,000 if the S&P 500 earns a typical 10% annual return price. -

Solely investing in corporations you “consider in.” The iShares International Clear Vitality ETF

is down 26.5% 12 months to this point, which implies an investor would want extra financial savings and aggressive investments elsewhere to hit monetary objectives. Remember that many theme funds or ESG merchandise spend money on power or closely in massive tech, says Rabe. - “Letting massive positive aspects cloud your judgment.” Threat administration ought to at all times be a precedence. So don’t base future selections on that massive crypto win. And at all times diversify — not simply digital currencies but in addition the inventory market.

- Concern of lacking out (FOMO). Social media is filled with younger buyers making a killing on cryptocurrencies throughout the pandemic, leaving everybody else to fret they’ll miss the subsequent massive growth. “They acquired very fortunate underneath distinctive circumstances…not a good benchmark to your personal success,” says Rabe. Cryptos are risky and speculative so make investments solely as a lot as the price of a pleasant lunch. Younger individuals are extra trusting of expertise so cryptos enchantment, however they lack regulatory buildings that make U.S. shares strong long-term investments. So make investments sparingly and diversify elsewhere.

- Choices investing: “They see friends on TikTok or Instagram discussing how they’ve made cash with these methods and wish in on the motion, however inexperienced buyers want to know that almost all equity-linked choices find yourself being nugatory,” says Rabe. These are an particularly dangerous thought for youthful buyers as a result of all of that cash will “probably disappear.” If the S&P 500 compounds at 10% for the subsequent 40 years, just like the final 40, $1,000 invested in that in the present day as a substitute of choices, would imply $45,000 in 4 many years.

Over time, the S&P 500 has persistently pushed previous all method of disaster to maintain transferring increased, notes DataTrek’s Rabe.

DataTrek

Plus: ‘Is that this a inventory market, or a on line casino?’ New 4X leverage S&P 500 ETN met with warning

The markets

Shares

have opened increased, led by expertise

.

Bond yields

are regular and gold

GC00

is up 0.7% to $2,050. Oil

CL

is down 2%. German shares

are climbing after Tuesday’s file shut.

The excitement

ADP stated private-sector companies added simply 103,000 jobs in November, from an anticipated 128,000. The commerce deficit rose to a three-month excessive of $64.3 billion, and U.S. labor prices have been revised right down to a 1.2% annual drop within the third quarter, and labor productiveness development was revised as much as an annual 5.2%.

Within the cloud area, Field shares

BOX

are sinking on weak gross sales steerage, with MongoDB

MDB

falling regardless of beating forecasts.

Brown-Forman shares are tumbling after the Jack Daniels guardian’s earnings fell in need of forecasts.

And: Apple is a $3 trillion firm once more, for the primary time since August

Wall Road financial institution CEOs, together with JPMorgan’s

JPM

Jamie Dimon, are on account of seem earlier than Congress on Wednesday, and are anticipated to warning in opposition to stiffer regulation for lenders.

British American Tobacco

BTI

wrote down the worth of its U.S. cigarette manufacturers by $31.5 billion, and its shares are off 8%, as that information additionally weighed on Altria

MO

and Philip Morris

PM

inventory.

A backlash in opposition to fast-fashion retailers is coming, warns Deutsche Financial institution.

Better of the online

How Russia punched an $11 billion gap within the West’s oil sanctions.

How a toy turns into the coveted ‘it’ reward of the vacation season.

Inflation is falling however rates of interest shall be increased for means longer.

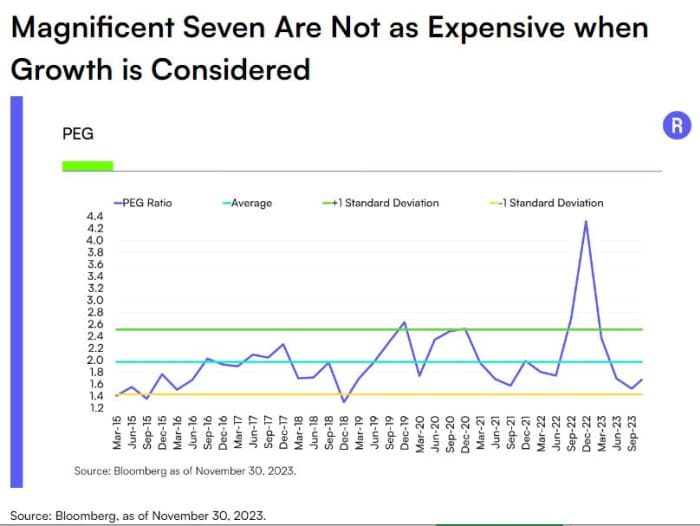

The chart

Are the Magnificent Seven shares — Alphabet

GOOGL,

Amazon

AMZN,

Apple

AAPL,

Meta

META,

Microsoft

MSFT,

Nvidia

NVDA,

and Tesla

TSLA

— really low-cost? Observe this chart from Dave Mazza, chief technique officer at Roundhill Investments:

Mazza focuses on the PEG ratio — value/earnings versus development — that may point out an organization’s true worth, and a decrease ratio means an undervalued inventory. PEGs of tech giants surged at finish 2022 to 4.32, however fell within the third quarter to a present 1.68, beneath the historic common of 1.97, so the Seven “may very well be undervalued when earnings development is taken into account,” he writes.

High tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m.:

Random reads

Gaelic soccer staff battles 72-year outdated curse

Lady sells dwelling for dream luxurious cruise that will get canceled.

Have to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your electronic mail field. The emailed model shall be despatched out at about 7:30 a.m. Japanese.