Knowledge exhibits the Bitcoin premium on Coinbase has shot up alongside the newest rally. Right here’s what this means concerning the supply of the surge.

Bitcoin Coinbase Premium Hole Has Turn out to be Extremely Constructive

As CryptoQuant Netherlands neighborhood supervisor Maartunn identified in a brand new submit on X, the cryptocurrency’s worth noticed its newest break after the Coinbase Premium Hole began rising.

The “Coinbase Premium Hole” is an indicator that retains monitor of the distinction between the Bitcoin costs listed on cryptocurrency exchanges Coinbase and Binance.

When the worth of this metric is optimistic, it implies that the worth listed on Coinbase is presently increased than on Binance. Such a pattern implies that the shopping for stress from the previous customers is bigger than that of the latter (or the promoting stress is much less).

Then again, a unfavorable worth means that Binance is observing the next shopping for stress than Coinbase as the worth listed there’s better.

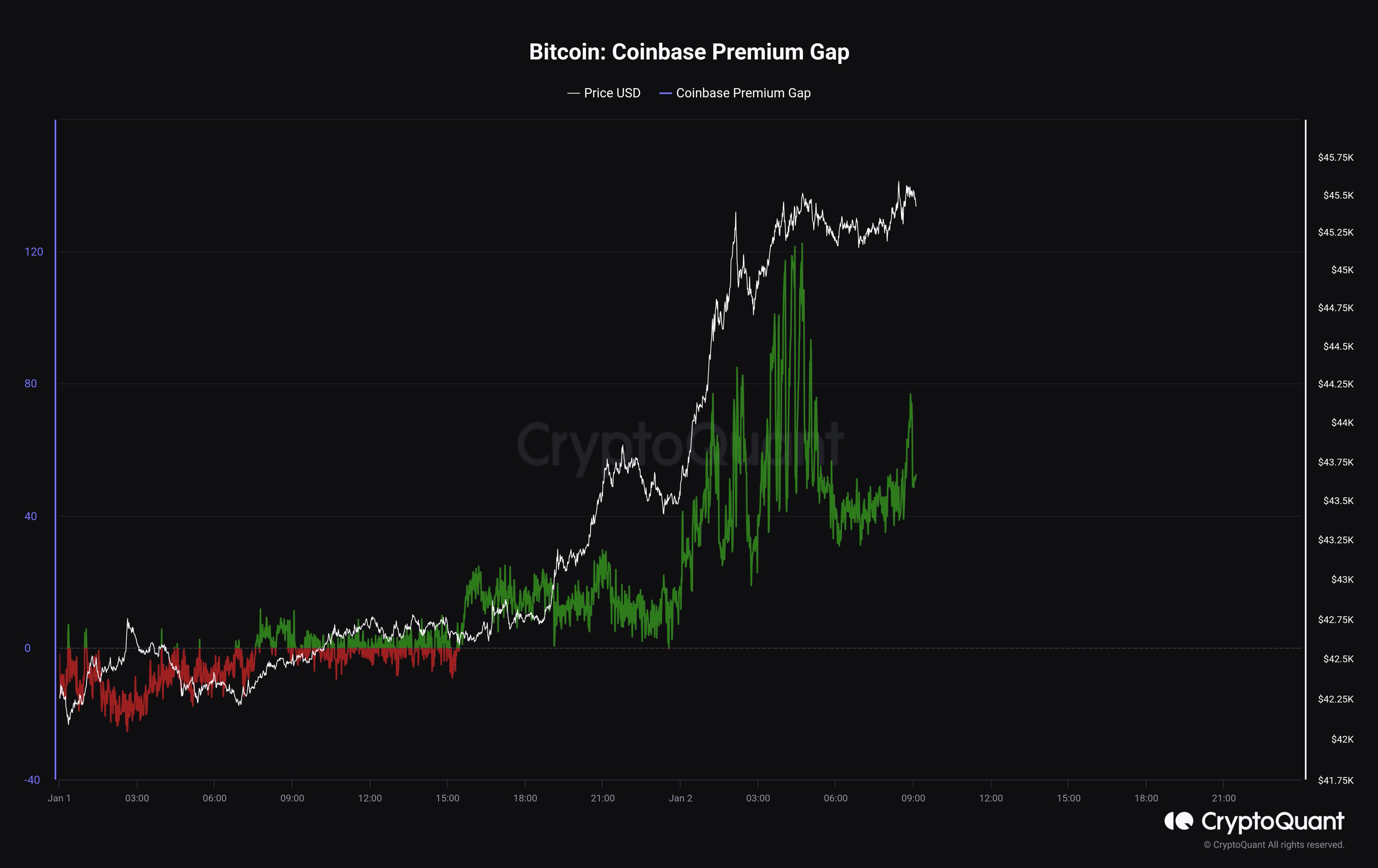

Now, here’s a chart that exhibits the pattern within the Bitcoin Coinbase Premium Hole over the previous couple of days:

The worth of the metric seems to have been fairly optimistic in current days | Supply: @JA_Maartun on X

Because the above graph exhibits, the Bitcoin Coinbase Premium Hole began taking notable optimistic values yesterday, implying that purchasing stress on the platform was hovering. Since then, the indicator has solely continued to shoot additional up.

Coinbase is thought for use by US-based institutional entities, so the metric’s worth can present hints about how the shopping for or promoting stress from these giant American buyers compares in opposition to that of Binance’s international consumer base.

For the reason that Coinbase Premium Hole has been optimistic throughout the previous day, it might seem doable that US institutional buyers have been taking part in accumulation.

The chart exhibits that alongside the rise within the indicator’s worth, the Bitcoin worth has additionally shot up and damaged previous the $45,000 barrier for the primary time since April 2022.

Given the timing, it could possibly be doubtless that the shopping for stress from the American whales has been a driver (if not the principle one) for the cryptocurrency’s newest upward thrust.

The surge has come because the sector has stored its eyes peeled for the approval of the asset’s spot exchange-traded funds (ETFs), which many anticipate to occur quickly. These US institutional holders may be shopping for into the identical hype.

Maartunn defined earlier {that a} correlation had emerged between the BTC spot worth and Coinbase Premium Hole. This newest occasion exhibits that this correlation, held over the past month of 2023, may also proceed to carry throughout the begin of 2024.

BTC Value

Bitcoin had gone as excessive as $45,900 earlier throughout the day however has since seen a pullback in the direction of $45,500.

The value of the coin appears to have sharply gone up over the previous day | Supply: BTCUSD on TradingView

Featured picture from Bastian Riccardi on Unsplash.com, charts from TradingView.com, CryptoQuant.com