Knowledge exhibits Upbit, the biggest Korean cryptocurrency alternate, has the altcoins contributing to 87% of the full buying and selling quantity.

87% Of The Buying and selling Quantity On Upbit Is Occupied By Altcoins

In a brand new put up on X, CryptoQuant founder and CEO Ki Younger Ju has posted a comparability of the buying and selling volumes between American and Korean cryptocurrency exchanges.

The “buying and selling quantity” right here refers back to the whole quantity of any given cryptocurrency (or a number of cash) that’s changing into concerned in some type of buying and selling exercise on a selected platform or group of platforms.

When the worth of this metric is excessive, it means a lot of tokens of the asset are being shifted on the platform presently, which may counsel that buying and selling curiosity round it’s excessive from the alternate’s customers.

Alternatively, low values suggest the coin in query could lack any curiosity from the traders as not an excessive amount of of it’s changing into concerned in buying and selling actions on the platform.

Now, here’s a chart that exhibits how the share of buying and selling quantity that Bitcoin, Ethereum, and the altcoins individually contribute on cryptocurrency exchanges Coinbase and Upbit has modified over the previous yr:

The distribution of the buying and selling quantity throughout these two platforms | Supply: @ki_young_ju on X

As is seen above, Coinbase, the biggest American alternate, has the altcoins contribute the biggest share to buying and selling quantity proper now, however their dominance isn’t one thing too overwhelming.

Upbit, the biggest Korean platform, then again, has the alts making up $34.2 billion in quantity, which is equal to 87% of the full quantity on the alternate in the intervening time.

This could counsel that Korean customers have a higher relative curiosity within the altcoins than American traders, who additionally commerce Bitcoin and Ethereum a good quantity.

This distinction in habits could also be all the way down to the kind of traders that go to the respective platforms. As Ju has famous in reponse to a consumer commenting on the put up, “The amount is primarily from retailers, primarily as a result of Korean exchanges prohibit institutional traders and international customers by legislation.”

Coinbase, nevertheless, is extensively identified for use by institutional traders, so though retailers would even be on the platform, the buying and selling quantity distribution could be skewed by these humongous entities.

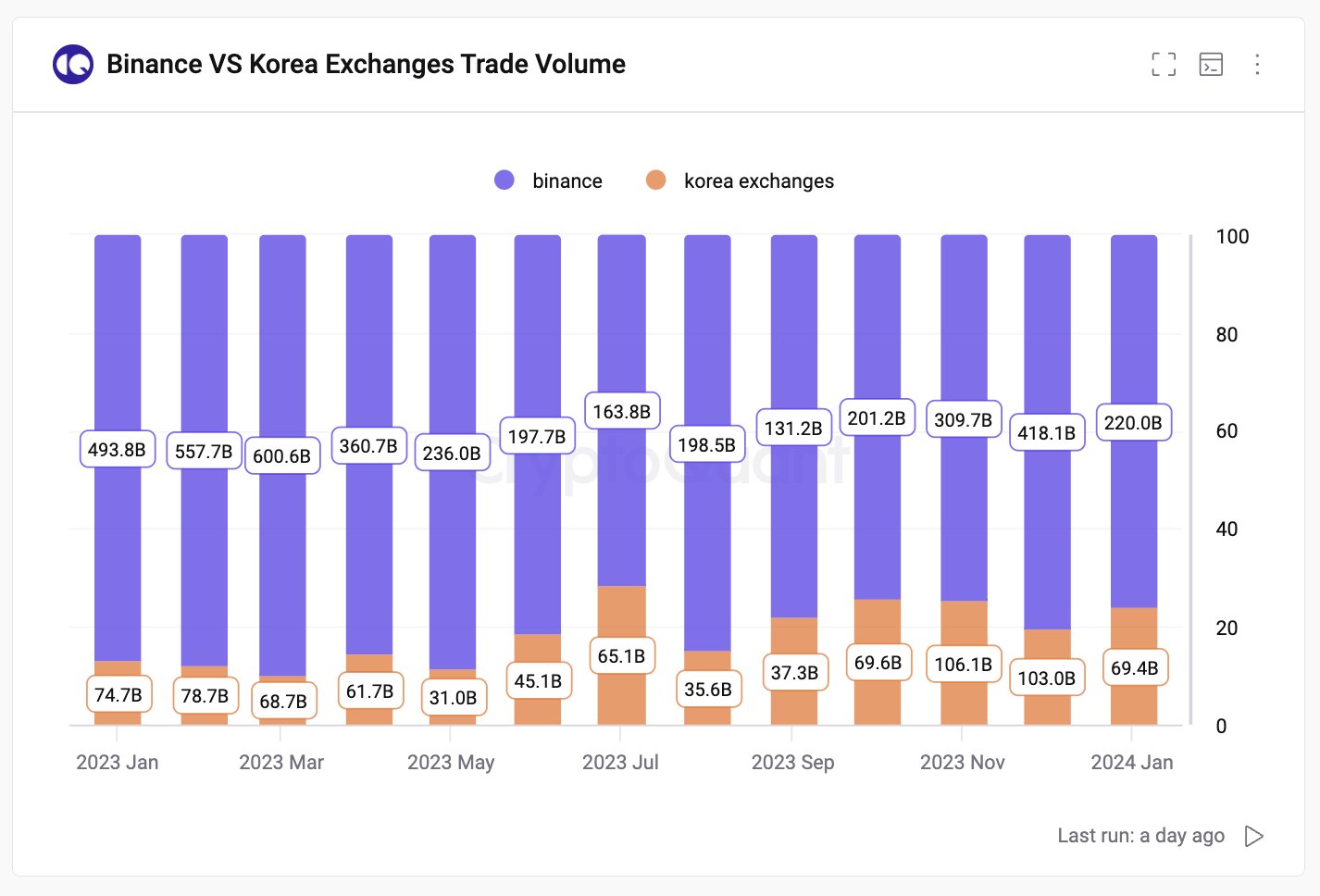

To provide perspective on the place of the Korean platforms within the higher trade, the CryptoQuant founder has shared a chart that compares the buying and selling quantity of those exchanges with Binance.

How the volumes on the 2 platforms have in contrast over the previous twelve months | Supply: @ki_young_ju on X

From the graph, it will seem that the full quantity on Korean exchanges proper now ($69.4 billion) is round 31% of the amount on Binance ($220 billion). The latter is the biggest cryptocurrency alternate on the planet based mostly on buying and selling quantity.

In line with the analyst, which means that the altcoin-dominant Korean exchanges have a 12% international affect.

BNB Worth

BNB, the biggest altcoin within the sector, has loved a 4% soar throughout the previous 24 hours, which has now taken its worth to $316.

Seems to be just like the altcoin has noticed a pointy rise over the past day | Supply: BNBUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, CryptoQuant.com