Bitcoin has damaged above the $52,000 mark as information exhibits that institutional merchants have continued to use their shopping for stress on the asset.

Bitcoin Coinbase Premium Is Notably Optimistic Proper Now

In keeping with CryptoQuant founder and CEO Ki Younger Ju, institutional brokers have been shopping for on Coinbase to meet their shoppers’ Bitcoin buy orders.

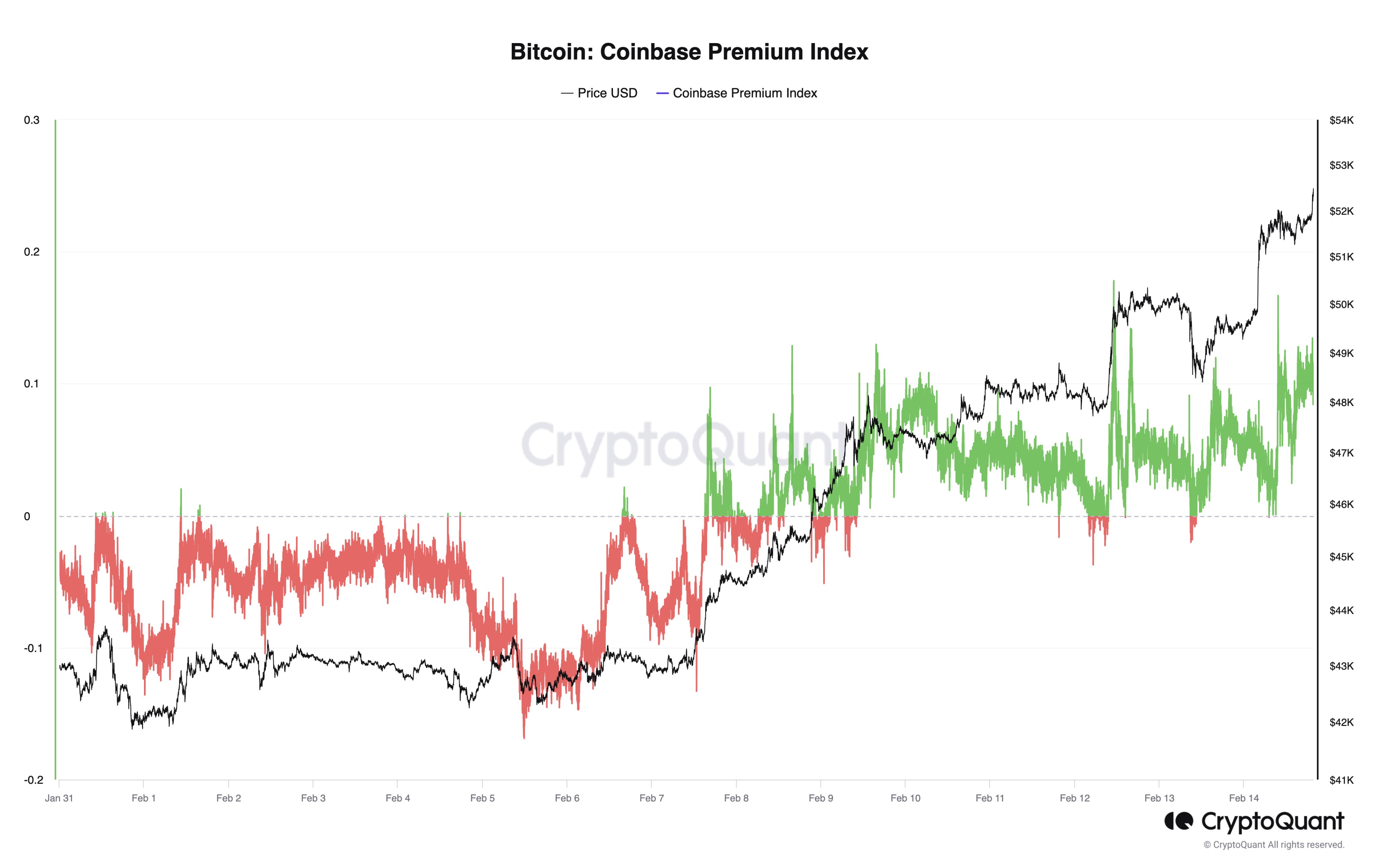

The metric of curiosity right here is the “Coinbase Premium Index,” which retains monitor of the proportion distinction between the BTC costs listed on cryptocurrency exchanges Coinbase and Binance.

The previous is popularly recognized for use by American institutional entities, whereas the latter has a extra world consumer base. As such, this metric can present us with hints in regards to the variations in these two demographics’ shopping for and promoting behaviors.

Here’s a chart that exhibits the pattern within the Coinbase Premium Index for Bitcoin over the previous couple of weeks:

The worth of the metric appears to have been fairly constructive in latest days | Supply: @ki_young_ju on X

The graph exhibits that the Bitcoin Coinbase Premium Index has been largely at constructive ranges through the previous week. This is able to recommend that the worth listed on Coinbase has stayed increased than on Binance.

Such a situation types when the shopping for stress from the previous’s customers is bigger than that of the latter. Alternatively, it will possibly additionally seem when the promoting stress on the previous is simply decrease.

The most recent constructive values, although, have occurred because the Bitcoin value has been marching up, that means that internet shopping for has been happening out there. As such, the inexperienced Coinbase Premium Index suggests the presence of comparatively excessive shopping for stress from US-based institutional merchants.

Throughout the first week of the month, the indicator had been destructive, and the worth had been consolidating sideways. Because the metric rose in direction of constructive ranges, nonetheless, this newest Bitcoin run kicked off, implying these giant entities’ function out there proper now.

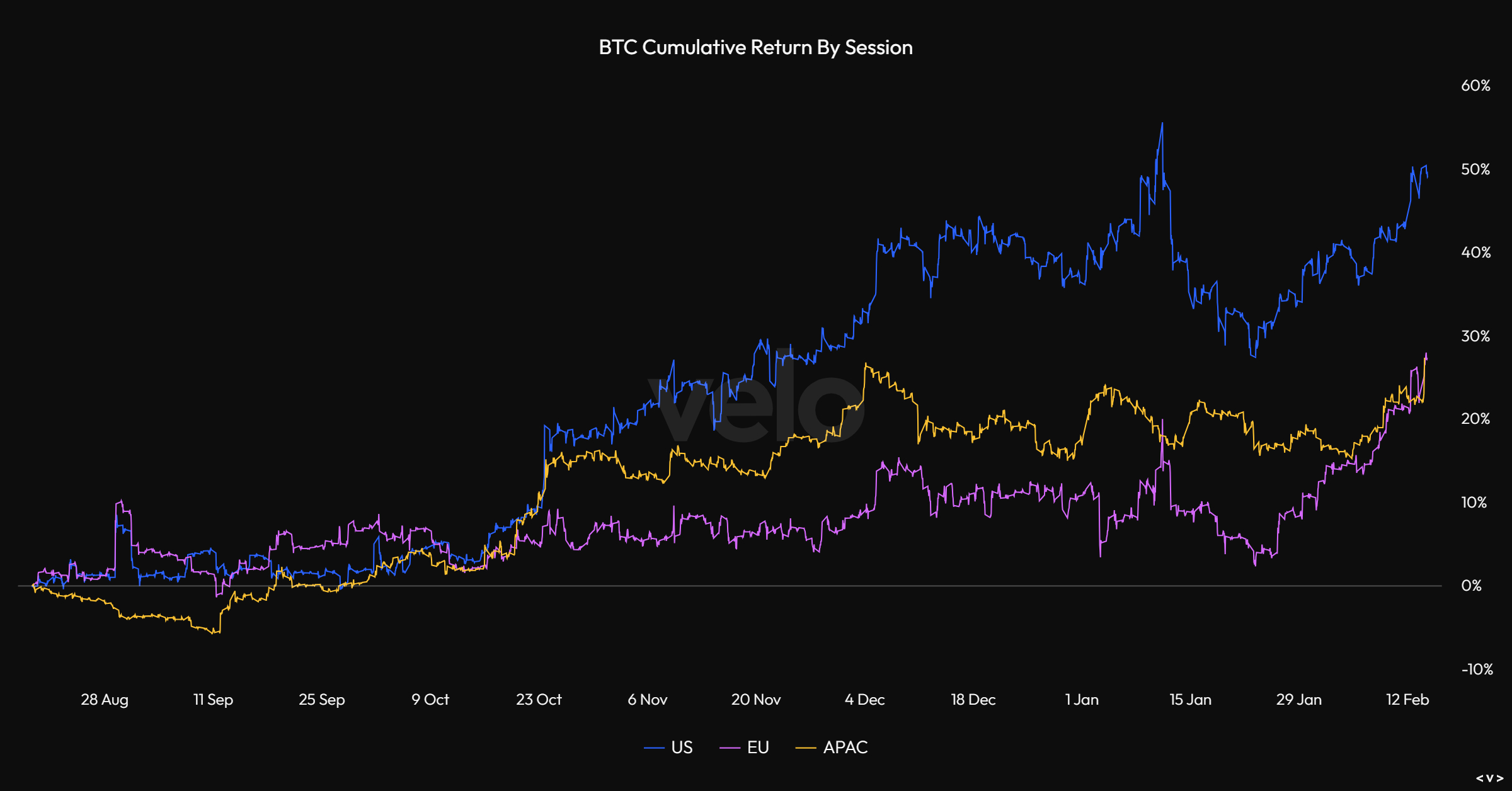

The info of the cumulative returns damaged down by session additionally signifies that American traders have certainly been the drivers behind the worth rally. Under is a chart shared by Reflexivity Analysis co-founder Will that exhibits this pattern.

The info for the cumulative returns by session for the asset over the previous couple of months | Supply: @WClementeIII on X

It could seem that Bitcoin has noticed essentially the most constructive returns throughout American buying and selling hours over the previous couple of months, additional confirming the presence of remarkable shopping for stress from US-based entities.

Given the connection that institutional habits on Coinbase and the BTC value has held just lately, the premium may very well be to look at within the coming days, as staying constructive might probably imply a continuation of the rally. On the identical time, a dip into the destructive territory would recommend these entities have taken to promoting.

BTC Value

Following the newest continuation to the rally, Bitcoin has now damaged above the $52,000 mark, because the chart beneath exhibits.

Seems just like the asset's value has been quickly going up over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, CryptoQuant.com, VeloData.app, chart from TradingView.com