The tech-heavy Nasdaq 100 index on Thursday scored a every day advance of over 3% to shut at its all-time excessive for the primary time since March 2000, a scene in some methods paying homage to the dot-com period over 20 years in the past which led as much as the bursting of the bubble preluded the recession, in response to Bespoke Funding Group.

“March 2000 is actually a scary interval to consider for buyers,” stated analysts at Bespoke in a shopper notice considered by MarketWatch on Friday. “Regardless that the Nasdaq 100

NDX

hasn’t skilled an over 3% acquire to shut at all-time highs since March 2000, there have been 32 of those situations all through the Nineties main as much as the final word dot-com bubble peak.” (See chart under)

SOURCE: BESPOKE INVESTMENT GROUP

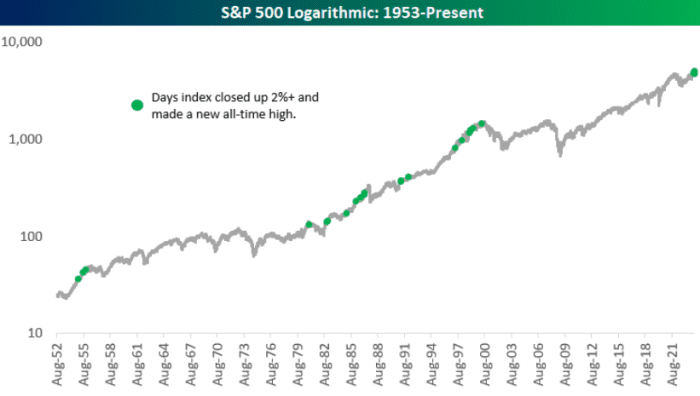

Much like the Nasdaq 100, Thursday was additionally the primary time the S&P 500

SPX

had a one-day advance of not less than 2% to shut at a brand new all-time excessive since March 2000, in response to knowledge compiled by Bespoke.

The inexperienced dots within the chart under spotlight the 21 instances the large-cap benchmark index had an over 2% acquire and closed at an all-time excessive since 1952, and the way it carried out within the days and weeks following these situations.

“Notably, the market did commerce heavy over the subsequent day, week, and month, however the index managed to common a acquire of roughly 2% over the subsequent three months,” Bespoke stated.

SOURCE: BESPOKE INVESTMENT GROUP

See: Nasdaq Composite on monitor for report shut after drought of greater than 2 years

The U.S. inventory market has been partying because it bottomed in October. Megacap expertise shares continued to paved the way, whereas buyers parsed by way of one other slate of quarterly outcomes that signaled an escalating AI frenzy and a flourishing financial system, whereas nonetheless struggling to cost in when the Federal Reserve will ship its first interest-rate lower in 2024.

Three benchmark inventory indexes on Thursday skyrocketed after a blowout income forecast from the AI darling Nvidia Corp.

NVDA,

which spurred the largest one-day acquire in market capitalization by any U.S. firm. The Dow Jones Industrial Common

DJIA

and S&P 500 indexes set one other spherical of report closing highs, whereas the Nasdaq Composite

COMP

settled simply shy of its first report shut since 2021, in response to FactSet knowledge.

See: Right this moment’s Huge Tech-dominated inventory market has shades of dot-com bubble, strategists warn

Market individuals have been debating whether or not the push into the so-called Magnificent Seven over the previous yr resembles the dot-com bubble of 1999, a interval when shares additionally rode a wave of expertise hype solely to return crashing down when the bubble popped in 2000 and brought about a light recession the next yr.

To make certain, Bespoke analysts didn’t draw a direct parallel between the dot-com bubble and the present inventory rally, however they stated the historic sample, in addition to the seasonality that subsequent month is often “one of many weakest intervals of the yr” might point out that the U.S. inventory market is due for a pullback over the subsequent few weeks.

U.S. shares have been edging greater on Friday afternoon, with the Nasdaq Composite wavering between features and losses, whereas the S&P 500 and the Dow industrials headed for an additional spherical of report highs and their greatest weekly features of the yr, per FactSet knowledge.