On-chain knowledge reveals that the Bitcoin whales’ holdings have grown to 25.16% of all the provide, and their internet accumulation has continued not too long ago.

Bitcoin Traders With 1,000 To 10,000 BTC Have Continued To Purchase Not too long ago

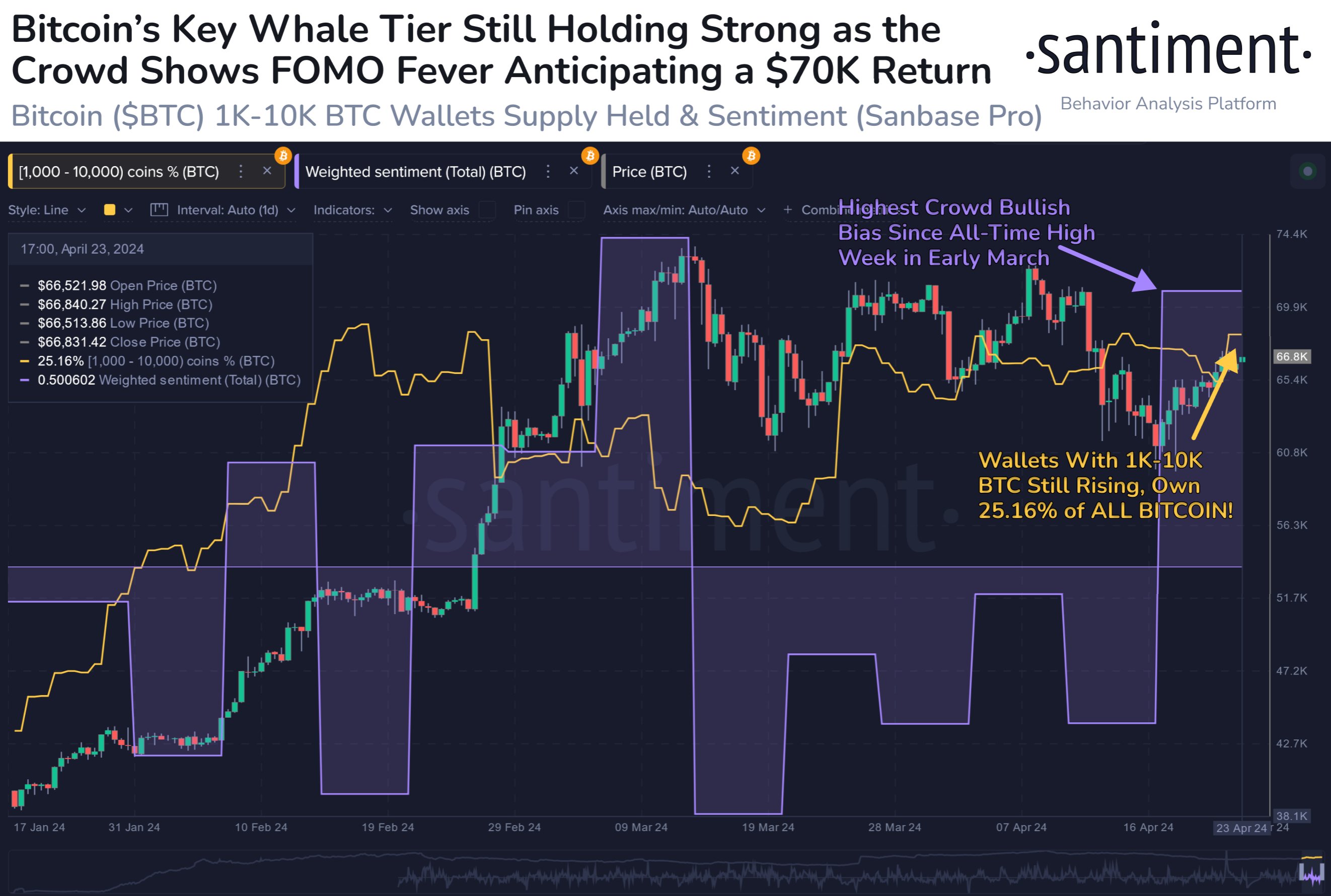

In line with knowledge from the on-chain analytics agency Santiment, the BTC whales have collected greater than 266,000 BTC because the begin of the 12 months. The indicator of curiosity right here is the “Provide Distribution,” which retains observe of the proportion of the full circulating Bitcoin provide that the assorted pockets teams are holding proper now.

The addresses are divided into these cohorts primarily based on the variety of cash they presently have of their steadiness. The ten to 100 cash group, for instance, contains all wallets that personal a minimum of 10 and, at most, 100 BTC.

The Provide Distribution sums up the quantity that traders belonging to a specific group as an entire are carrying and calculates what proportion of the availability they contribute.

The 1,000 to 10,000 BTC cohort is of curiosity within the present dialogue. On the present trade charge, the decrease restrict for this cohort is $65 million, whereas the higher one is $650 million.

Clearly, the traders belonging to the group are fairly large, and as such, they’re popularly often known as “whales.” Because the whales can shortly transfer giant quantities, they’ve the potential to affect the market. On account of this, their habits will be value watching.

There are whales past this cohort’s 10,000 BTC higher restrict as properly, however at such large scales, entities like exchanges additionally begin coming into play, who aren’t precisely regular traders.

Now, here’s a chart that reveals the development within the Bitcoin Provide Distribution for the 1,000 to 10,000 cash group over the previous couple of months:

The worth of the metric appears to have noticed a spike in latest days | Supply: Santiment on X

As displayed within the above graph, the Bitcoin Provide Distribution for this key investor group has noticed a internet rise over the 12 months 2024 thus far. The whales have purchased 266,000 BTC ($17.2 billion) over this era.

Nonetheless, this accumulation hasn’t been constant. As is seen within the chart, the whales offered into the rally that might ultimately result in the asset’s new all-time excessive, and so they purchased again in as soon as the drawdown was over.

As BTC has consolidated, so has its provide. Nonetheless, the newest change within the metric has been in direction of the upside, implying that these humongous holders are maybe backing the present restoration push.

Following the newest accumulation, the 1,000 to 10,000 cash group holds 25.16% of the availability, which signifies that greater than 1 / 4 of all Bitcoin in circulation is sitting within the wallets of those giant traders.

Whereas whale shopping for is bullish, the present investor sentiment is probably not so. As the info for the “Weighted Sentiment” metric connected by Santiment within the chart suggests, traders are presently displaying FOMO in direction of the asset.

Traditionally, Bitcoin has tended to maneuver in opposition to the bulk’s expectations, so FUD/concern has been supreme for uptrends to begin. FOMO/greed, then again, has been the place tops have turn into possible.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $64,700, up greater than 7% over the previous week.

Appears to be like like the value of the asset has retraced a few of its latest restoration over the previous couple of hours | Supply: BTCUSD on TradingView

Featured picture from Vivek Kumar on Unsplash.com, Santiment.internet, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site solely at your personal danger.