Information reveals the Bitcoin Open Curiosity has seen a surge to a brand new all-time excessive (ATH) not too long ago, an indication that volatility might be brewing for BTC.

Bitcoin Open Curiosity Has Been Going Up Not too long ago

As identified by CryptoQuant founder and CEO Ki Younger Ju in a brand new submit on X, the Bitcoin Open Curiosity has simply set a brand new report. The “Open Curiosity” right here refers to an indicator that retains monitor of the full quantity of BTC-related derivatives positions which might be open on all centralized exchanges.

Beneath is the chart shared by Younger Ju that reveals the pattern on this metric over the previous few years:

The worth of the metric seems to have been heading up in current days | Supply: @ki_young_ju on X

As is seen within the graph, the Bitcoin Open Curiosity has been on the rise not too long ago, which means that the buyers have been opening contemporary positions in the marketplace. Following the newest continuation of the rise, the indicator has hit a worth of $20 billion, which is a brand new report. As for what this excessive might imply for the cryptocurrency’s value, a excessive Open Curiosity is mostly adopted by sharp volatility within the asset.

On paper, this volatility can take the coin in both route, however from the graph, it’s obvious that peaks within the indicator have, the truth is, often led to tops for the cryptocurrency.

The supply of the volatility is often mass liquidation occasions, which may be possible to happen when the market has a considerable amount of positions with excessive leverage concerned.

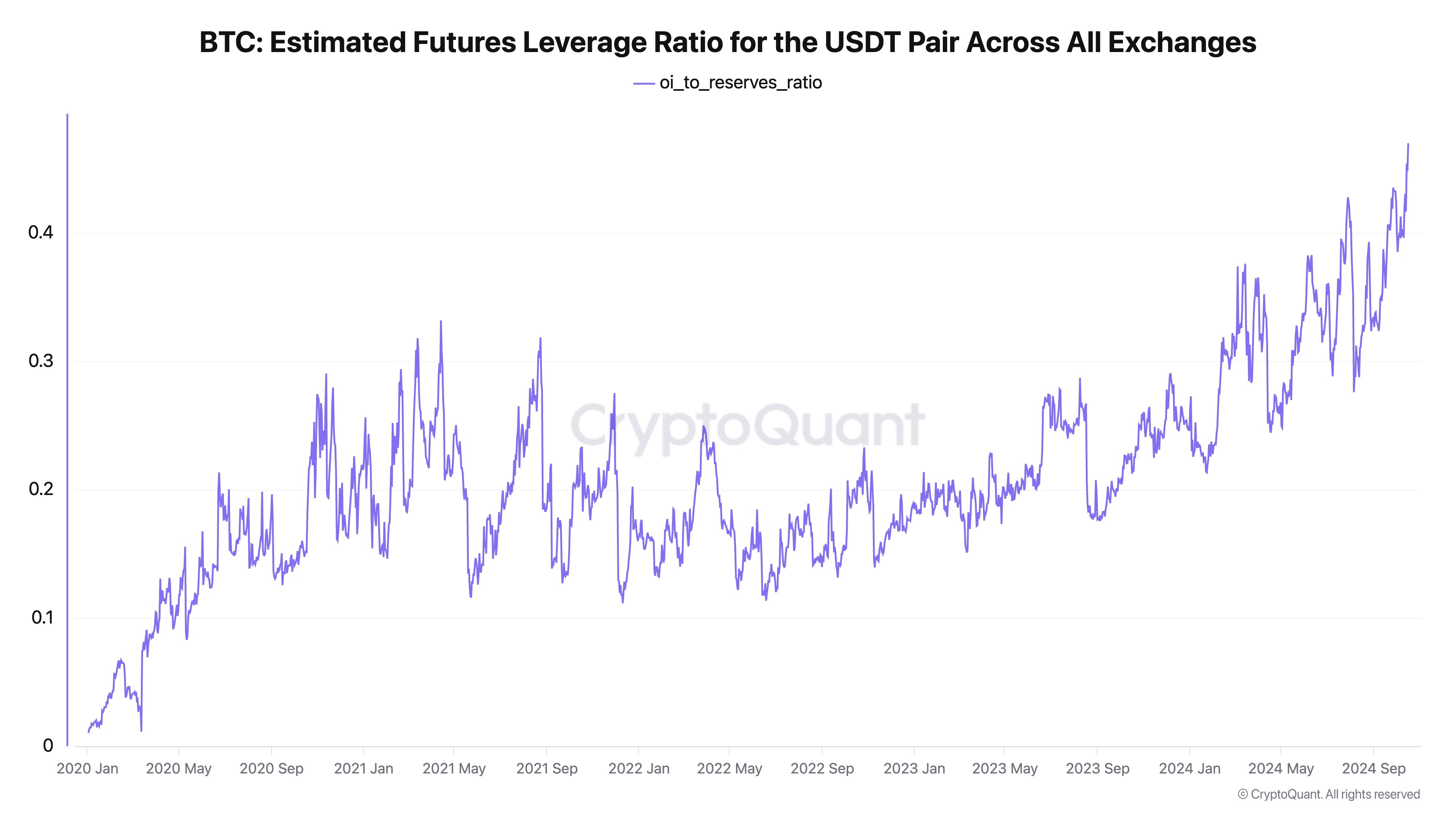

In one other X submit, the CryptoQuant CEO shared the info for the Bitcoin Estimated Leverage Ratio, which principally tells us in regards to the common quantity of leverage that customers are presently choosing.

Seems to be like the worth of this metric has additionally been rising not too long ago | Supply: @ki_young_ju on X

The Estimated Leverage Ratio is calculated because the ratio between the Open Curiosity and the full trade reserve of the underlying asset. Within the present case, Younger Ju has posted the model of the indicator that tracks the positions which have Tether’s stablecoin, USDT, because the collateral.

Whereas this definitely doesn’t cowl your complete market, this model of the metric can nonetheless present us with a touch of the overall pattern being adopted by merchants as an entire.

As displayed within the above graph, the Bitcoin Estimated Leverage Ratio for the USDT pair has shot up not too long ago, which means the buyers have elevated their urge for food for threat.

Thus, with all this leverage concerned, BTC might actually be prone to seeing a unstable explosion. Contemplating that these new positions which were popping up might be lengthy positions, the merchants betting on a bullish final result could as soon as once more be those to get caught up within the volatility.

BTC Value

Bitcoin had crossed above the $68,000 stage yesterday, however the asset seems to have seen a pullback since then because it’s now all the way down to $67,200.

The value of the coin seems to have been using an uptrend over the previous few days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com