On-chain information suggests the trail to $2,500 may very well be open for Ethereum now that the asset has managed to cross the $2,100 mark.

Ethereum Has No Main Resistance Ranges Till $2,500

In a brand new publish on X, the market intelligence platform IntoTheBlock has supplied an replace on how the Ethereum ranges are trying when it comes to on-chain assist and resistance. In on-chain evaluation, ranges are outlined as assist or resistance based mostly on what number of buyers acquired their cash inside them.

The under chart exhibits the density of addresses at numerous ranges above and under the present spot value of the cryptocurrency:

The quantity of holders that acquired their cash at every of the completely different ETH value ranges | Supply: IntoTheBlock on X

Typically, every time the Ethereum value retests the associated fee foundation of an investor, they might be extra more likely to present some form of transfer. When this retest occurs from above, the holder could also be inclined to imagine the value will go up once more quickly so they might see the retest as a “dip” and thus, would possibly resolve to purchase extra.

Associated Studying: Polygon (MATIC) Jumps One other 6% As Whales Present Excessive Exercise

Then again, the investor might wish to exit the market if the retest is from under, as they could concern the value would go down once more sooner or later, and by promoting on the break-even mark, they might at the very least keep away from incurring any losses.

A couple of buyers exhibiting such habits is clearly not sufficient to trigger any seen results available on the market, but when a lot of buyers share the identical price foundation, the asset might very properly really feel a sizeable response.

From the chart, it’s seen that there are some massive price foundation facilities under the present Ethereum ranges, suggesting the presence of robust potential assist ranges.

Earlier, when the asset had nonetheless been under $2,000, the $2,000 to $2,100 vary posed because the final main resistance boundary to interrupt. Because the coin has now risen above these costs, it’s potential that the vary can be switching its position in the direction of being assist as a substitute.

Following this newest rally, about 75% of the holders at the moment are in revenue (that’s, their price foundation is within the ranges under). As is seen within the graph, there are not any value ranges with a excessive density of buyers within the upcoming value ranges, till the $2,500 mark.

“Does this imply it’s a clear run to a brand new ATH? Not essentially,” explains IntoTheBlock. “Traditionally, profit-taking at these ranges is frequent and results in pullbacks. Nonetheless, that is unlikely to considerably impression Ethereum’s long-term trajectory.”

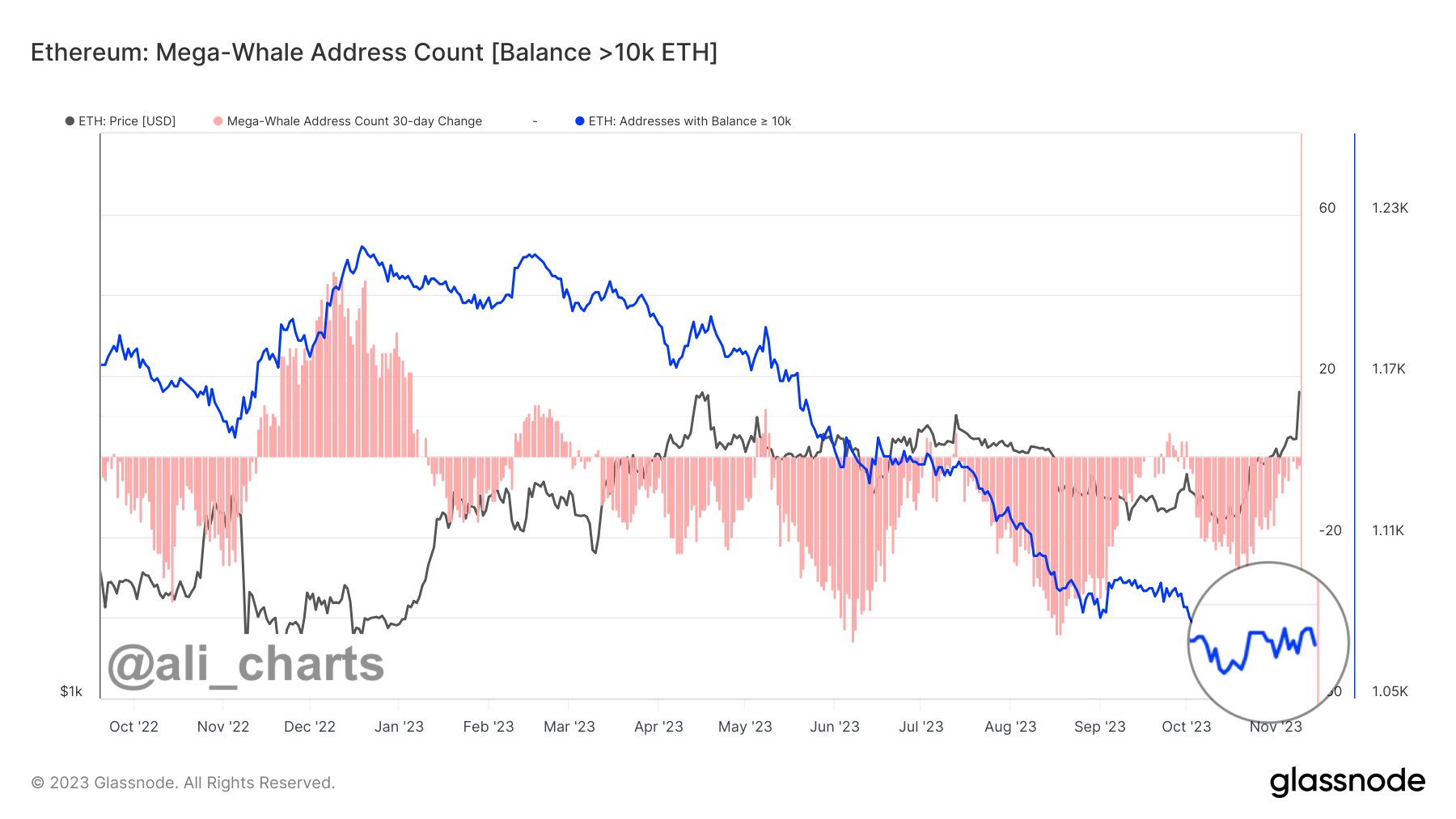

Analyst Ali Martinez has additionally identified one thing attention-grabbing in an X publish at present. He revealed that the most recent rally in ETH has occurred with out the assist of the most important of the Ethereum whales (carrying a steadiness higher than 10,000 ETH), the so-called “mega whales.”

Appears like the worth of the metric has been shifting sideways lately | Supply: @ali_charts on X

As highlighted within the graph, the whole variety of addresses owned by the Ethereum mega whales has been flat lately. “Ethereum has reclaimed the $2,000 threshold, and intriguingly, that is all taking place earlier than whales have even began shopping for ETH!” notes Ali.

ETH Value

After a surge of greater than 9% up to now 24 hours, Ethereum has arrived on the $2,100 degree for the primary time since April.

The asset's value seems to have exploded through the previous day | Supply: ETHUSD on TradingView

Featured picture from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, Glassnode.com, IntoTheBlock.com