The month of March is just not ending too shabby, because the banking mess appears calmer for now. After an unsightly February, the S&P 500 SPX

is ready for a 1.4% acquire, whereas the Nasdaq Composite is poised to leap 4%.

Forged the web wider, says ours name of the day from Charles Schwab Chief World Funding Strategist Jeff Kleintop, who believes worldwide equities are an ignored alternative proper now.

“That is an space that buyers have shunned for greater than a decade, however each month this 12 months worldwide shares have outperformed U.S. shares by means of recession fears in January, to overheating and inflation in February and to the monetary disaster in March,” Kleintop stated in an interview. MarketWatch on Wednesday.

Undoubtedly, the 12 months is younger. Schwab Worldwide Fairness Change Fund (ETF) SCHF,

which has 4 stars on Morningstar, is up 6.4% this 12 months versus a 17% drop in 2022 – SPDR S&P 500 ETF Belief SPY,

mirroring the principle index, rose almost 5% after falling 19% final 12 months.

“We have persistently seen one of the best performers in worldwide equities, they usually’re up 6% this quarter, which is a reasonably rattling good return, they usually’ve additionally crushed lats for the 12 months for the primary time in a decade,” Kleintop stated.

It benchmarks the Stoxx Europe 600 index XX:SXXP

earnings are anticipated to rise 6% within the first quarter, versus unfavourable 5% for the S&P. “The banking burden is just not as acute in Europe and valuations are a lot decrease. So I believe that is an space the place buyers can discover enticing alternatives in a extra unstable surroundings,” he stated.

Learn: Worldwide shares outperform, separation from US shares ‘uncommon’

“Just about each nation in Europe has seen constructive financial surprises over the previous month, so their information is coming in higher than anticipated. Once more, earnings look fairly good, estimates are decrease,” Kleintop stated. Worldwide corporations additionally provide a lot of what buyers ought to be searching for now — near-term money movement, he stated.

As for Wall Road, the strategist fears extra volatility this 12 months. Like others, he is involved in regards to the U.S. business actual property sector, which may be difficult, particularly with smaller banks lending.

“First, they do not have a variety of earnings as a result of they’ve very excessive vacancies, and second, borrowing cash to pay for these properties is kind of excessive… This isn’t the case exterior the US, the place there may be comparatively little business actual property. the riskiness of banks and the extent of vacancies are a lot, a lot decrease,” he stated.

Elsewhere, Kleintop stated smaller U.S. corporations, which frequently do properly after a downturn and recession worries, might face challenges given their reliance on debt and lack of robust money movement profiles in comparison with power, supplies and industrials.

Kleintop’s last level focuses on what he sees as a possible blind spot for buyers.

“I believe my primary concern is that inflation is available in waves prefer it did with COVID… I do not assume the markets are prepared for inflation to go up once more for a month or two earlier than it comes down. Markets count on the Fed to have the ability to reduce charges later this 12 months, and I do not know if that may stay the case if we begin to see some form of pick-up in inflation.”

Learn: The primary wave of deposit outflows is nearly over. The second wave has already begun, says the strategist.

Markets

DJIA shares

SPX

COMP

headed for three-week highs with bond yields BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

the greenback charge DXY can be rising

falls. CL00 oil

is 1%.

For extra market updates and actionable buying and selling concepts for shares, choices and crypto, subscribe to MarketDiem from Investor’s Enterprise Day by day.

Hud

Fourth-quarter GDP was revised as much as 2.6% annual progress from 2.7%, whereas weekly jobless claims rose by 7,000 to 198,000, the best degree in three weeks. Extra to return: Boston Fed President Collins and Richmond Fed President Barkin will converse at 12:45 p.m., with Minneapolis Fed President Kashkari at 1 p.m. A Wall Road Journal reporter has been arrested in Russia on espionage fees.

RH inventory RH

fell 6% after the holding firm, residence items retailer Restoration {Hardware}, reported revenue and gross sales declines in its newest quarter.

Inventory Roku ROKU

rose greater than 2% after the streaming media group stated it reduce 200 jobs and decreased using some workplace area. Digital Arts EA

is shedding 6% of its workforce because the online game writer joins the tech trade’s cost-cutting efforts. These shares are up a bit.

Extra job cuts information from Warner Music WMG,

which plans to chop its workforce by 4%, or 270 jobs.

EVgo promotion EVGO

rose 3.5% after the electrical car charging infrastructure firm reported almost 4x income progress, beating forecasts, as losses narrowed sharply.

The common bonus on Wall Road fell 26% to $176,700 final 12 months, the New York Securities and Change Fee stated.

The perfect of the Web

‘It says I owe $179,000’ – Choices merchants make huge margin calls as profitable bids towards the banks stay in limbo for weeks

Fiery French protests and a widespread Israeli strike mirror the rift with democracy. The US is just not insured.

Airbnb’s CFO believes that demand for journey and new experiences is “way more sustainable than shopping for a brand new Fendi bag.”

Diagram

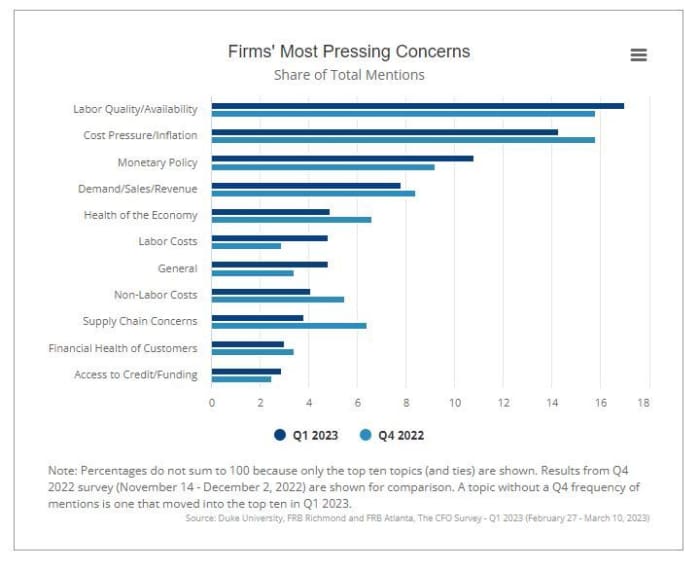

In keeping with the newest quarterly survey of CFOs carried out by Duke and the Federal Reserve Financial institution of Richmond and Atlanta, CFOs of American corporations are least involved about entry to credit score and financing. Their largest concern is discovering high quality staff, adopted by inflation, because the chart beneath reveals:

Tickers

As of 6 a.m., these have been the preferred tickers on MarketWatch

Occasional readings

The price of relocating Pablo Escobar’s hippos? 3.5 million {dollars}.

As soon as and for all, begin consuming like a Mediterranean.

Why digital cameras can stand the check of time.

Must Know begins early and updates earlier than the decision, however enroll right here to get it delivered to your inbox. The e-mail model shall be despatched at roughly 7:30am EST.

Hearken to the Greatest New Concepts in Cash podcast with MarketWatch reporter Charles Passey and economist Stephanie Kelton.