The bond market is the primary query preoccupying strategists in the meanwhile. Even after the large drop in yields following the roles report, the 10-year yield

BX:TMUBMUSD10Y

has climbed 24 foundation factors during the last three weeks, and the 30-year

BX:TMUBMUSD30Y

has jumped 31 foundation factors.

Mike Wilson, Morgan Stanley’s strategist who appears to by no means miss a chance to recall how incorrect he’s been this yr on the inventory market, says the U.S. has hardly ever posted such massive deficits when the unemployment fee is so low. “If fiscal coverage is displaying such little constraint in good occasions, what occurs to the deficit when the subsequent recession arrives,” he asks. The latest backup in yields ought to begin to name into query fairness valuations, he says.

Morgan Stanley/Haver Analytics

The workforce at BNP Paribas say the latest improve in yields is just not an overshoot, although they do admit being caught abruptly by the pace and nature of the transfer. “We predict there’s a clear argument for an extra rebuild of time period premium, biasing curves steeper and retaining long-end yields stickier into an eventual downturn,” say strategists led by Sam Lynton-Brown, international head of technique.

That’s much like what Invoice Ackman mentioned final week, when he mentioned he was shorting 30-year Treasurys. Proper now, estimates of time period premium, like this one from the New York Fed, are detrimental. That’s, buyers usually are not seeing the dangers in holding longer-term paper versus shorted-dated securities.

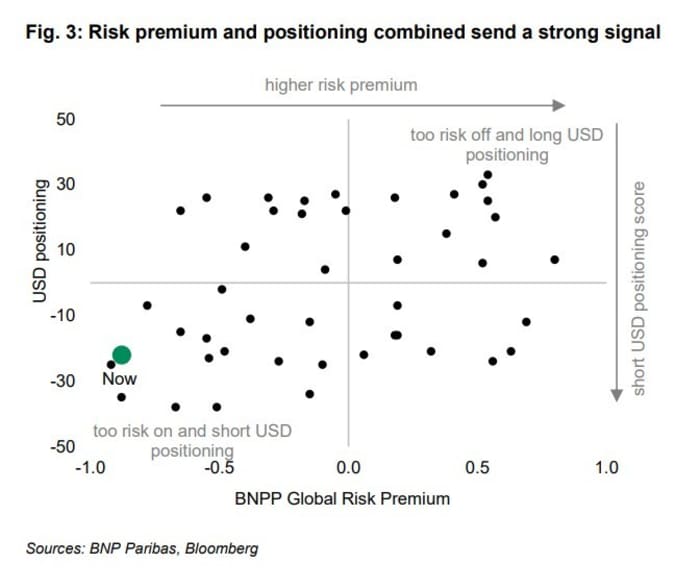

In a be aware entitled, “summer time threat burnout,” BNP sees scope for an additional risk-off week, following the two.3% decline within the S&P 500

SPX.

Its mannequin of the worldwide threat premium nonetheless factors to warning, whereas prolonged brief U.S. greenback positioning is traditionally excessive. Plus, they are saying, its seasonality evaluation reveals the subsequent two weeks is usually bullish for the greenback, bullish for foreign money volatility — which it says is a number one indicator — and reasonably bearish for equities.

BNP additionally brings again a narrative that was on the forefront of minds when the debt ceiling was lifted, particularly the reversal in liquidity situations. The French financial institution factors out that a lot of the international transfer there pertains to European banks having to repay loans to the European Central Financial institution in June. “The market reacts with a lag to liquidity contractions – peak cumulative impression on key belongings is often reached between 8-12 weeks of a liquidity shock.”

The markets

U.S. inventory futures

ES00,

NQ00,

had been transferring increased early on Monday. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was 4.10%.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Enterprise Every day.

The excitement

Whilst you had been on the seashore this weekend, Berkshire Hathaway

BRK.B,

reported its second-quarter outcomes, and the takeaway was that working earnings rose by 6%.

There wasn’t an excessive amount of commentary so we’ll hand the evaluation over to the weblog Rational Stroll: “Through the annual assembly, Warren Buffett mentioned that he expects the vast majority of Berkshire’s non-insurance companies will report decrease earnings in 2023. Nonetheless, increased rates of interest have benefited Berkshire’s holdings of treasury payments. In consequence, barring main catastrophes, Mr. Buffett expects (however didn’t promise) that working earnings will improve in 2023. Up to now, this prediction seems to be enjoying out.”

The buyer value index is due Thursday, however forward of that, client credit score information is due for launch at 3 p.m.

Monday’s consequence calendar consists of Tyson Meals

TSN,

and after the shut, Paramount International

PARA,

kicking off an enormous week for the media sector.

Trucking firm Yellow

YELL,

filed for chapter. Its inventory final week surged 405%.

Better of the net

Indiana exams if the heartland can remodel right into a microchip hub.

America’s self-storage dependancy.

Some Wells Fargo deposits disappeared final week in what the financial institution calls a technical downside that was resolved.

Prime tickers

Listed below are probably the most lively stock-market tickers as of 6 a.m. Jap.

| Ticker | Safety title |

|

TSLA, |

Tesla |

|

TUP, |

Tupperware Manufacturers |

|

NIO, |

Nio |

|

TTOO, |

T2 Biosystems |

|

AMC, |

AMC Leisure |

|

AAPL, |

Apple |

|

AMZN, |

Amazon.com |

|

NKLA, |

Nikola |

|

PLTR, |

Palantir Applied sciences |

|

NVDA, |

Nvidia |

The chart

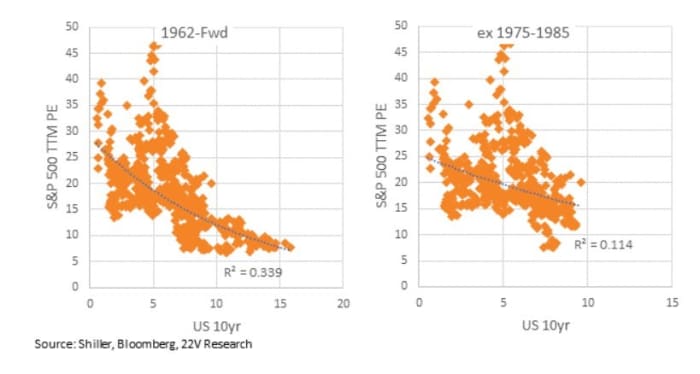

A lot has been made that shares look costly relative to the 10-year yield. Dennis DeBusschere of 22V Analysis pushes again on that view, charting the connection between price-to-earnings ratios and the 10-year yield again to 1962 — and likewise doing that when eradicating the 1975 to 1985 expertise that featured stagflation and the Volcker Fed. “What is apparent from the charts, the present stage of the 10-year yield, and even increased from right here [5% to 6%] doesn’t mechanically recommend a lot decrease PEs. Different components, like money return, incomes development, monetary situation expectations, and so on., are the bigger driver of PEs.”

Random reads

A person made practically $300,000 — returning doorways he didn’t purchase to The Residence Depot.

The newest trash discuss on the hypothetical cage match been Zuck and Musk.

Have to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model might be despatched out at about 7:30 a.m. Jap.

Hearken to the Finest New Concepts in Cash podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.