China’s largest property developer, Nation Backyard, defaulted on curiosity funds on dollar-denominated debt with a face worth of $1 billion on Monday, sparking steep promoting of its bonds and elevating recent fears about China’s extremely indebted actual property sector.

The developer missed $22.5 million of curiosity funds that had been due Monday, because the Wall Avenue Journal reported. Costs of the 2 bonds, that mature in 2026 and 2030, promptly fell under 8 cents on the greenback and remained at distressed ranges on Wednesday.

As the next chart from data-as-a-service firm BondCliQ Media Providers exhibits, the corporate’s bonds had been buying and selling at cents on the greenback on Wednesday.

Historic worth efficiency of Nation Backyard debt. Supply: BondCliQ Media Providers

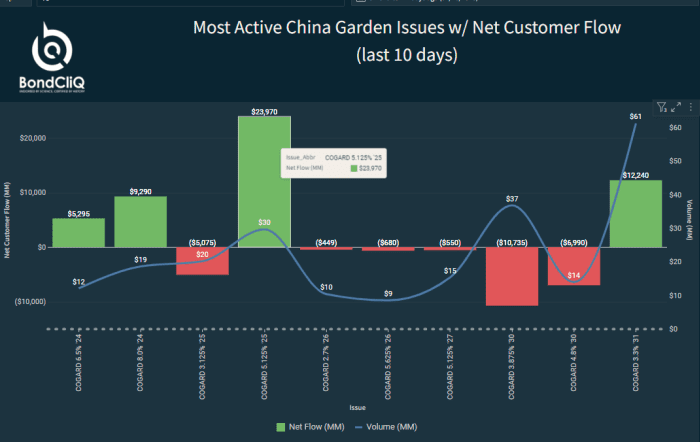

Over the previous 10 days, there was higher shopping for into the dip, as this chart exhibits.

Most energetic China Backyard points with web buyer circulate (final 10 days). Supply: BondCliQ Media Providers

Nation Backyard has a grace interval of 30 days to make the curiosity funds earlier than bondholders can ship a discover of default.

However the money crunch has reignited considerations about China’s actual property sector after different defaults together with from China Evergrande Group within the final two years.

From the archive: Evergrande fears sink inventory market: Right here’s what traders have to know concerning the teetering property big

The corporate was unable to make its curiosity funds due to the current deterioration in its gross sales and a scarcity of accessible funds, a spokesperson instructed the Journal.

Nation Backyard has been beset by unhealthy information in current weeks amid market hypothesis about its monetary well being. The corporate issued a warning on July 31 that it might e-book a web loss for the primary half, the Journal reported individually, as China’s housing market has deteriorated.

That may mark its first interim loss because it went public in Hong Kong 16 years in the past. As lately as six months in the past, the corporate seemed to be ready to get via China’s housing downturn with out defaulting on its U.S. greenback bonds.

China’s actual property sector is sagging underneath the load of a large debt load taken on over the previous few a long time. The COVID pandemic and subsequent prolonged lockdowns have exacerbated the issues and a much-hoped for restoration this yr has did not materialize.

Associated: China’s property woes supply a window into the demise of the nation’s increase occasions

Commerce information launched on Tuesday confirmed China’s exports fell greater than anticipated in July, weighed down by continued weak spot in world demand, as Dow Jones Newswires reported.

Outbound shipments dropped 14.5% from a yr earlier in July, in contrast with the 12.4% decline in June, the Basic Administration of Customs stated. The outcome was worse than the 12.0% fall anticipated by economists in a Wall Avenue Journal ballot.

Chinese language imports declined 12.4% from a yr earlier in July, in contrast with June’s 6.8% fall and the 5.0% drop anticipated by surveyed economists.

On Wednesday, information confirmed China’s client costs fell for the primary time in additional than two years in July, whereas the nation’s factory-gate worth index declined at a slower price, as Dow Jones Newswires reported.

Additionally see: Buyers begin to fret that China, Europe might drag U.S. economic system down with them