On-chain information exhibits the Bitcoin profit-taking has risen to a two-month excessive, which may present resistance to the BTC surge.

Bitcoin Revenue-Taking Quantity Has Shot Up With The Worth Rise

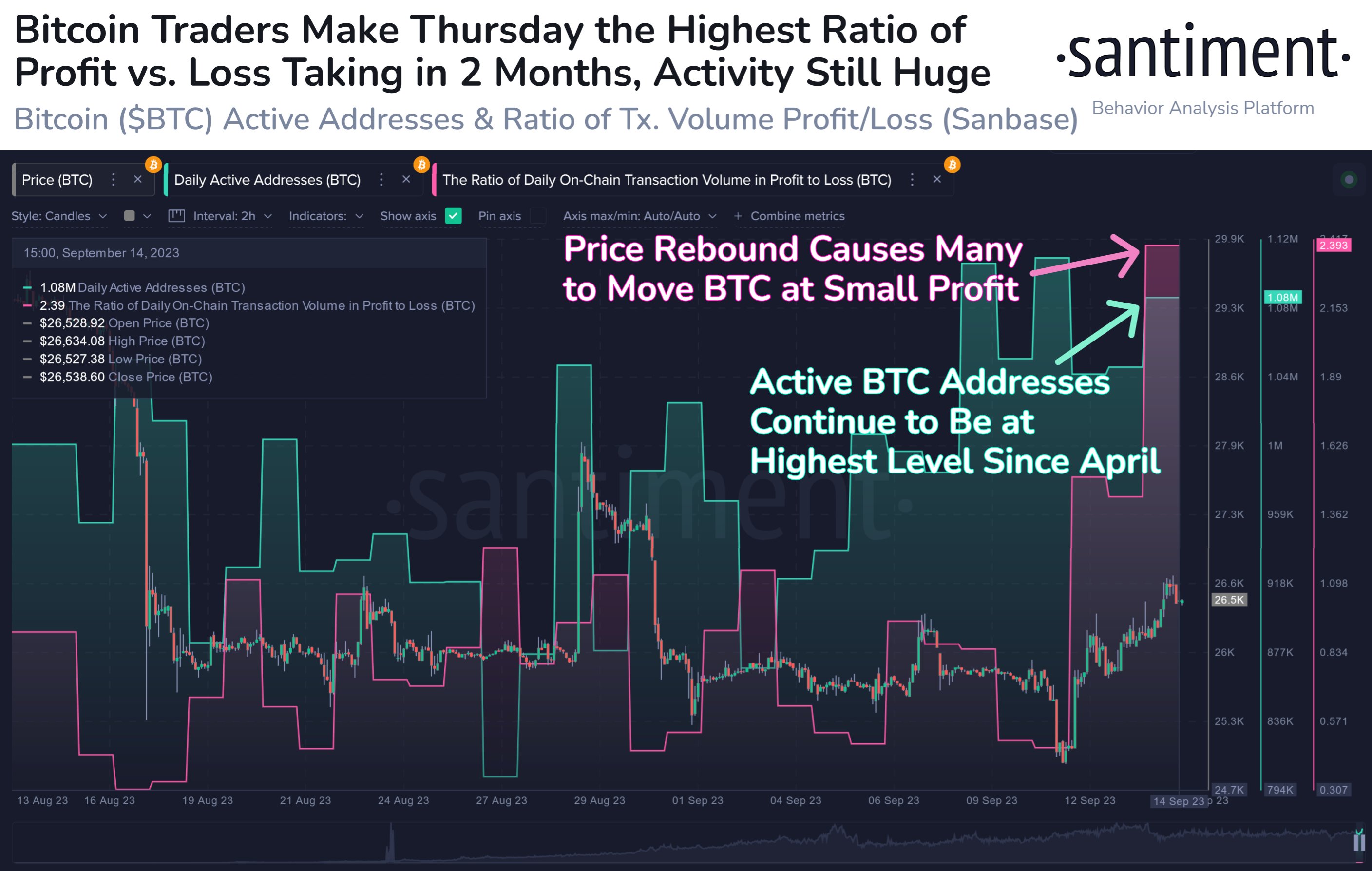

In response to information from the on-chain analytics agency Santiment, buyers have began to take earnings following the newest cryptocurrency value enhance. The related indicator right here is the “ratio of day by day on-chain transaction quantity in revenue to loss,” as its title already implies, it tells us how the profit-taking quantity available in the market at the moment compares towards the loss-taking one.

The indicator separates these two volumes by going by means of the on-chain historical past of every coin being bought/transferred on the community to see what value it was beforehand moved at.

If this final promoting value for any coin was lower than the present spot value, the sale of that individual coin contributes to the profit-taking quantity. Equally, their transactions would rely underneath the loss-taking quantity for the other kind of cash.

When the indicator has a price higher than zero, the profit-taking quantity is at the moment overwhelming the loss-taking quantity. However, values underneath this mark recommend that loss-taking is at the moment the dominant habits amongst buyers.

Now, here’s a chart that exhibits how the worth of this Bitcoin indicator has modified over the previous month:

Seems to be like the worth of the metric has surged to a excessive worth in current days | Supply: Santiment on X

As displayed within the above graph, the indicator’s worth has risen as Bitcoin’s rebound from the $25,000 degree occurred in the course of the previous few days. This means that the buyers have began growing their profit-taking quantity.

Through the previous day or so, the metric has seen exceptionally excessive values, because the distinction between the profit-taking and loss-taking volumes is at a two-month excessive now.

Normally, profit-taking is a traditional signal throughout value rallies. Nonetheless, contemplating that this newest enhance in BTC’s worth isn’t too extraordinary, the extent of the revenue promoting could also be a trigger for concern.

Maybe among the holders promoting right here have misplaced hope for the asset after it has been caught in consolidation for a while now. These buyers could be leaping on this comparatively minor exit alternative as a result of they don’t suppose a greater one will emerge shortly.

Within the chart, Santiment has additionally connected the info for an additional metric: the energetic addresses. This indicator retains observe of the whole variety of addresses participating in some switch exercise on the blockchain day by day.

It’s seen that this metric has been at notably excessive values previously few days, suggesting that many merchants have been taking note of the cryptocurrency.

Whereas sellers could also be current available in the market, the excessive exercise may additionally recommend the presence of patrons. It stays to be seen whether or not the profit-takers would pull the asset again down, or if the patrons are robust sufficient to carry them off.

BTC Worth

Bitcoin had climbed to the $26,700 mark yesterday however dropped again underneath $26,500 at this time.

BTC has noticed a internet rise in the course of the previous few days | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Santiment.internet